Investors in the peer-to-peer lending platform Collateral (UK) Limited are set to receive their first pay out, over four years after the firm collapsed in early 2018.

Some £5.5m has been identified by the Joint Liquidators, with payments expected to start within a matter of weeks.

Please donate to the Cheese Fund to support crowd-funded journalism of the P2P sector.

Reporting by Daniel Cloake

Background to the insolvency

The joint liquidators, Mr Shane Crooks and Mr Mark Shaw of BDO LLP, were originally appointed as the Companies’ joint administrators by the Court on 27 April 2018, upon the application of the Financial Conduct Authority.

The companies transitioned into creditors’ voluntary liquidation in May 2019, and Mr Crooks and Mr Shaw became the duly appointed joint liquidators.

Prior to their entry into administration on 27 April 2018, Collateral UK Limited, along with the wider group of Collateral companies operated an online peer-to-peer lending platform.

Peer-to-peer (or P2P) lending is a type of finance arrangement where members of the public collectively crowdfund a loan to a borrower. The platform typically acts as an agent in the transaction.

As the date of Administration it is understood the two loan books (property and chattels) totalled some £16.47m.

The FCA take action

In January 2022 the FCA launched criminal proceedings against the two former directors of Collateral, and a trial date has been set.

As proceedings are considered active, strict reporting restrictions are in place to avoid prejudicing the trial. This blog post has been written with these in mind.

The Insolvency Hearing

At a hearing on June 13th 2022, Mr Alexander Riddiford, the barrister representing the Joint Liquidators, told the court that his clients wished to distribute funds to the investors.

In written submissions Mr Riddiford explained that “the Liquidators invite the Court to proceed as if the CASS Rules apply in this case, or in any case that the trusts on which [Collateral UK Ltd] holds Investors’ monies fall to be construed consistently with the CASS Rules“.

The so-called CASS Rules (named after the Client ASset Sourcebook in which they’re found) are the FCA’s client money handling rules.

Treating the CASS rules as applicable would trigger a requirement for the Joint Liquidators’ to distribute client money to those investors entitled to it – good news to those who have been waiting over four years for their money to be returned.

During the hearing, Insolvency & Companies Court Judge Mark Mullen requested to hear submissions on “the possible alternative outcomes if the CASS rules are not to be applied.”

In handing down his decision ICC Judge Mullen concluded that if the CASS rules didn’t apply: “the difference that would be made to the investors between a distribution on the basis [of what the liquidators say], and others is likely to be minimal to the point where it is simply uneconomic for them to argue it.“

Before adding: “I will however, as discussed with counsel, provide that a person who wishes to vary my order will have to do so as part of their appeal and as counsel rightly notes it would be extremely difficult for such a person to do so when they have had notice of this application.“

The Client Account

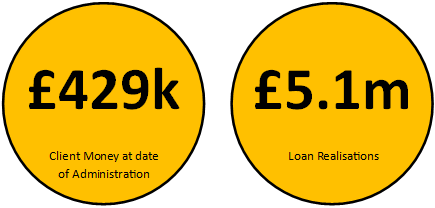

The court was told that the Collateral Client Account held some £429,307.30 at the date of Administration. Evidence was shown to the court which “sets out a detailed analysis of the constituent sources of this fund“.

The account may have comprised of monies which had been placed on the platform but yet to be invested in loans, or loan repayments and interest which had not been withdrawn.

In the event of a shortfall in the client account an investor would receive, as Mr Riddiford submitted, “a sum which is rateable to their entitlement to the pool“.

Loan realisations

In written submissions, the court was told that since the Companies entered administration on 27 April 2018, the liquidators (formerly the joint administrators) have received a total of some £5.1m from borrowers either directly or following the sale of the security.

We were told that the liquidators have kept the monies received in respect of each loan in a separate, blocked account (i.e. one account for each Loan).

This is because in each case “a distinct population of Investors” had funds allocated to a particular loan, and therefore now have a claim to the realisations from that particular loan to which their funds were allocated.

We were told that the sum of £5.1m represents realisations from some nineteen discrete loans with the number of investors exposed to each of these 19 loans ranging from 100 to 700.

Written submissions explained that even in those cases where a loan has now been repaid in full (including principal and interest), there are no cases where an investor stands to be fully repaid. We were told this is as a result of the various costs and expenses associated with enforcing the security (receivers’ costs, legal and agency fees) and other administration fees.

The liquidators have taken enforcement action in respect of the remaining 11 loans and whilst “further realisations are expected“, with some of the loans “it is currently unclear whether the Security holds any realisable value.“

Tranching

Some of the loans were apportioned to various investors on a so-called ‘tranched basis’, with certain tranches to be paid in priority to others (and with different investors exposed to different tranches).

The tranching was effected by dividing a Loan into discrete sub-loans, with each subsequent sub-loan being given (i) a subordinate ranking but (ii) a higher rate of interest.

We were told it was the liquidators’ intention to honour the contractual ranking of the sub-loans when effecting distributions of the Loan recoveries to the investors entitled to them.

It was said in written submissions that this proposed approach had been made clear to investors, and no objection had been raised.

Who is owed what?

The liquidators’ say they produced a ‘detailed exposure schedule’ for each of the individual investors and shared it with them. Whilst a number of the investors have disputed the liquidators’ analysis regarding their client money entitlement “the Court will see that the points of dispute are marginal” and concern “very small amounts of money“.

Additionally, we were told that the vast majority of investors “have simply failed to provide any significant comment at all“. Whilst the liquidators’ assume that where no comment has been received then this signals an agreement to the schedule, they don’t discount the possibility that further challenges might be received.

“In any case, it is hoped that the present process (including the forthcoming hearing, should any interested party seek to attend) will serve to flush out any Investors who may consider that they have grounds to dispute their ‘detailed exposure schedules’, or indeed any third parties who consider themselves to be an Investor with a proprietary claim” it was said in written submissions.

It was however noted that: “At the time of sending out the ‘detailed exposure schedules’ by e-mail in June 2020, approximately 20 e-mails “bounced back” – suggesting that some Investors may have no longer been using the e-mail addresses held by the Liquidators (and consequently would not have received their ‘detailed exposure schedules’“.

Steps prior to the distribution

Mr Riddiford explained that in order to distribute the monies held to investors, his clients would wish to impose a time limits for claims. This so-called ‘bar date’ would, when reached, prevent investors from disputing their ‘detailed exposure schedules’.

The liquidators would also want to prevent any other person who had not been identified as an investor, as of the bar-date, from being able to lodge a claim against the monies held.

Another requirement, asked for by the liquidators’, is the implementation of a ‘dispute resolution mechanism’ to deal with any disputed proprietary claims.

Mr Riddiford submitted that it would not “be appropriate or permissible for the Liquidators to see to the distribution of these trust monies to Investors in the absence of such directions from the Court“.

Judgment

In handing down the courts decision on whether the treatment of funds should be subject to the CASS rules ICC Judge Mullens said:

“the company was acting as agent and holding monies for investors for the specific investments they chose to make. They were not monies the company was free to deal with themselves. That being so the liquidators have proceeded here on the basis that those trusts ought to be treated in a way that vindicated the expectations of those investors. The companies have failed, and the CASS rules ought to apply“

“Nobody has objected to that. There is a creditors committee and the FCA itself has stated that it does not object as if the CASS rules apply in this case. That seems to me to be a sensible approach to take.“

“I’ve explained that there has been very significant work on behalf of the liquidators and I have been taken quite carefully by Mr Riddiford in his written and in his oral argument to the communications with investors and the proposals that the liquidators have in respect to the administration of the trusts in their hands and none of the company creditors, whether investors or other forms of creditors, have objected to the treatment which is now envisaged.“

“It’s a well-established maxim of the court to not allow a trust to fail for want of machinery, in this case the administration of the monies in the hands of the liquidators would be entirely stultified if there was not a machinery in place of the sort contemplated.“

What happens next?

The court was told that the Liquidators propose, by a specified date, to re-send the ‘detailed exposure schedules’ to the Investors.

Then, a number of days after a specified date (falling after the bar date), the liquidators be permitted to distribute the Client Money to those investors entitled to them.

In handing down Judgment ICC Judge Mullens agreed with the proposals saying:

“The detailed investor statement will be sent to the investors at the contact details the liquidators have for them. That will have to be done along with a covering letter telling them about the existence of this order and a brief precis of what this order determines.“

“The distribution is to be permitted in accordance with paragraph 3 and 4 [of the draft order] which in the summary provides for the liquidators’ to withhold very small sums of money when making interim payments out so that they are not having to send out cheques for £5 here and there, or less than £5 here and there, and to treat a distribution as a final distribution for less than £5 as being equivalent to a nil entitlement for the purposes of giving effect to the final distribution.“

“I do so on the basis that the administrative costs of dealing with such a small amount of money are likely to outweigh the costs of the benefit to anyone of making that distribution and I similarly direct that to the extent there is a shortfall to the individual funds that have been put together by the administrators, those losses can be apportioned [pro-rata] and that will extend to recognising the sub-ordination of the sub loans to earlier loans made in relation to a part borrower.“

“The bar date I think should be set at 35 days after receipt of the detailed exposure schedule and the covering note as described. That is a satisfactory period to enable a person to consider their position, it is likely that the sums of money, at least, in dispute are likely to be very small and it is unlikely that the remainder of the provision, to apply to the court to appeal within 21 days, will come into effect.“

“It is necessary that they are there, and that they are approved.“

“Finally I will make the provision set out in part D of the order, in part I will include that a provision that the liquidator and the companies and any other person who has notice of the order shall apply to the court to vary it or modify it if they see fit by the bar date in the case of the investors and within 35 days of notice of the order in relation to any other creditor.“

The effect of this Judgment could mean investors see their cash within, assuming no disputes, as little as 5-weeks. This may be considered highly optimistic though.

Case Details

Case Numbers:

CR-2018-001526 Collateral Sales Limited

CR-2018-001527 Collateral Security Trustee Limited

CR-2018-001528 Collateral (UK) Limited

In the High Court of Justice

Business and Property Courts of England and Wales

Insolvency and Companies List

Monday 13th June 2022 – 2:30pm

Remotely via MS Teams

Before ICC Judge Mullen

Companies application

One thought on “Collateral investors given green light to receive £5.5m payment, court rules”