The former Chief Financial Officer at failed peer-to-peer lending firm Lendy says he was dismissed for threatening to whistleblow the CEO’s alleged “get around the rules” conduct to the FCA, an employment tribunal has heard.

Today we heard claims that Lendy employees were forced to meet in the car park to avoid being heard by “office listening devices”.

And how reviews on TrustPilot were artificially manipulated to show higher ratings of customer satisfaction.

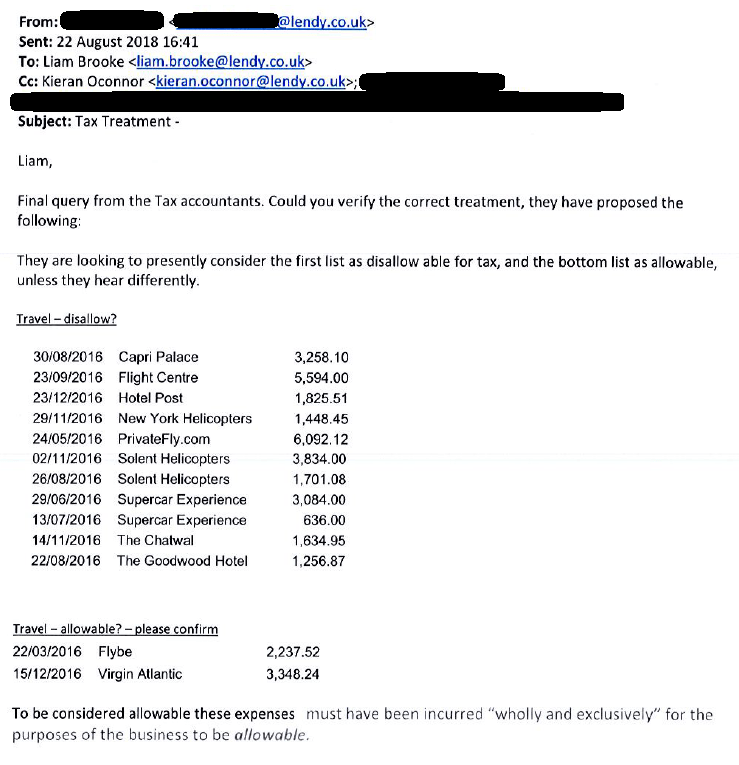

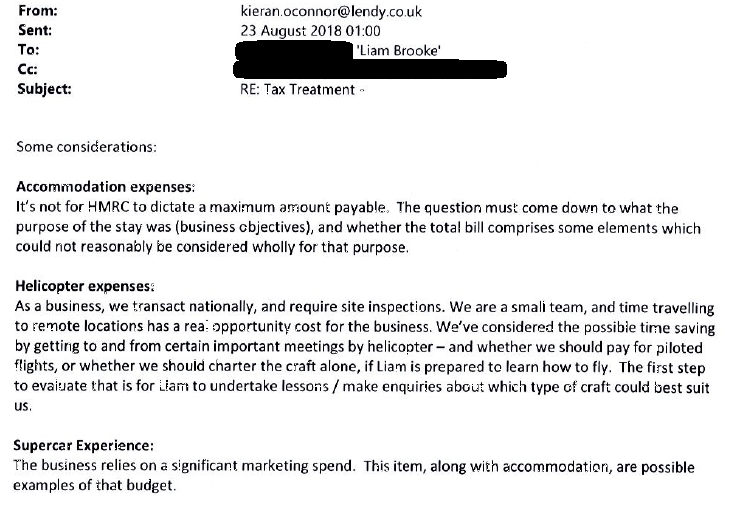

See e-mails suggesting how a New York helicopter trip and a supercar experience could be justified as a business expense

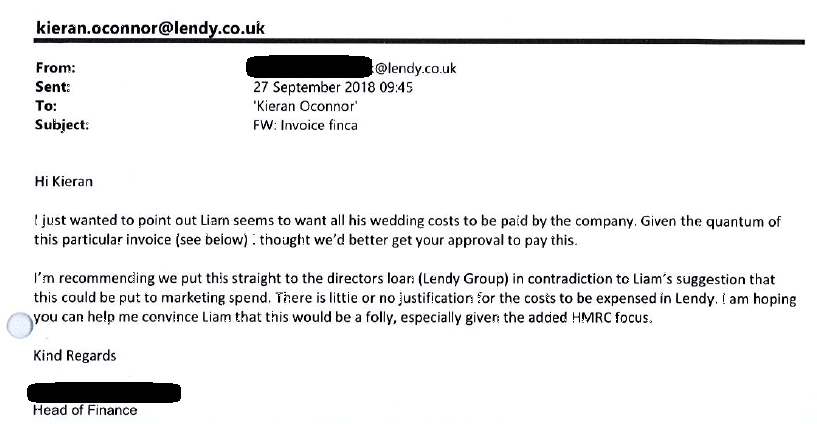

And how Liam Brooke “directed that Lendy should pay his wedding expenses and record the outlays as Lendy’s ‘marketing’ expenses”

Please donate to the Cheese Fund to support crowd-funded journalism of the P2P sector.

Contemporaneous Tribunal Reporting by Joe Morgan, additional reporting by Daniel Cloake.

Kieran O’Connor, 56, was appointed as CFO at the FCA regulated firm Lendy in June 2018, and was dismissed in November of the same year.

Mr O’Connor is pursuing a claim of unfair dismissal against his former employer Lendy Ltd, and a claim in respect of detriment against former CEO and director Liam Brooke, 40, of Southsea following the making of what are said to be protected disclosures.

The claims, which total £6.6m, include compensation for loss of salary (£750k), loss of bonus (£2.75m), and £36,100 towards “hurt feelings and embarrassment at the circumstances of my dismissal“.

Lendy entered into administration in May 2019, leaving over £160m outstanding on the loan book, with at least £90m of those funds in default.

The first day of this Employment Tribunal Hearing can be read on this blog “Former Lendy CFO’s £6.6m Employment Tribunal claim begins“. The tribunal did not sit on 3rd August due to unforeseen circumstances.

Mr O’Connor explained in written submissions that his relationship with his former line manager started off well. Mr Brooke is said to have “relied on [O’Connor] as his most trusted advisor and confidante” but “that close relationship changed dramatically” when Mr O’Connor told him he “couldn’t accept his direction not to make the information in my protected disclosures available to the FCA.“

In late 2018 the company was rapidly running out of money, investor confidence was dwindling, litigation from borrowers loomed, and scrutiny from the FCA was increasing. It is said Mr Brooke wanted to exit the business and saw Mr O’Connor’s attempts to convey information to the financial regulator as “an immediate and serious risk to [Mr Brooke’s] economic interests“.

Both Lendy and Mr Brooke deny Mr O’Connor’s claims.

This evidence was entered at a remote hearing at the London Central Employment Tribunal.

Retained Interest

The tribunal heard claims around the so-called retained interest account. A borrower who requested an amount of money would see the interest for that loan added to it and that total amount would be displayed on the platform. So a member of the public who invested £100 would see (as an example) £80 go to the borrower and £20 go into the retained interest account. The investor would be paid their interest from that account on a monthly basis.

How that money should be treated was contentious within the company with speculation over whether it belonged to the investor lender, the borrower, or Lendy.

Mr O’Connor alleged he attempted to stop former CEO Liam Brooke from taking money from the retained interest account to make up shortfalls in loans made to borrowers. Sometimes this money would be replenished by actual investors.

Mr O’Connor said: “Not all of that money had been restored and, in some cases, Liam Brooke had kept the interest, fees and profit share as Lendy’s own.”

Mr O’Connor claims he urged Lendy to tell the FCA that Lendy had not created any records purporting to determine what share of interest it claimed.

The former CFO also said the amount Lendy had been deducting, even for the share accorded to customers, didn’t match the amounts provided for in the documents, and thirdly, that he had uncovered reliable information casting doubt on Lendy’s entitlement to any share of interest, whatsoever.

Mr O’Connor claims when he brought this to Mr Brooke’s attention, he was dismissed that very week with no notice in an attempt to “silence and discredit” him, executing that plan on “entirely fabricated and groundless allegations”.

The tribunal was brought because he says he is unemployable after allegedly being smeared by the company for “lacking skills in financial management and compliance”.

Mr O’Connor said in his statement: “At the heart of all this, lies the dramatic U-turn in Liam Brooke’s relationship with me, immediately he realises that I cannot follow his direction to remain silent and that I must also brief the FCA on the critical disclosures I laid out for him on 7 November 2018.

“That was an abrupt change. Liam Brooke had gone from endorsing me as his closest confidante and as the partner with whom he was about to launch an entirely new business, to discrediting me, dismissing me without notice or any hearing, and retaining lawyers to threaten me.

“All of this was explained by the risk I suddenly posed to the sale of his shares in Lendy – which was at a critical juncture.

“When Liam Brooke was suddenly faced with that conundrum, he explored ideas that might control me and prevent that disclosure.”

Mr O’Connor said when he had first joined the company, there were two moments when he said that he should have spoken up against Mr Brooke as the CEO.

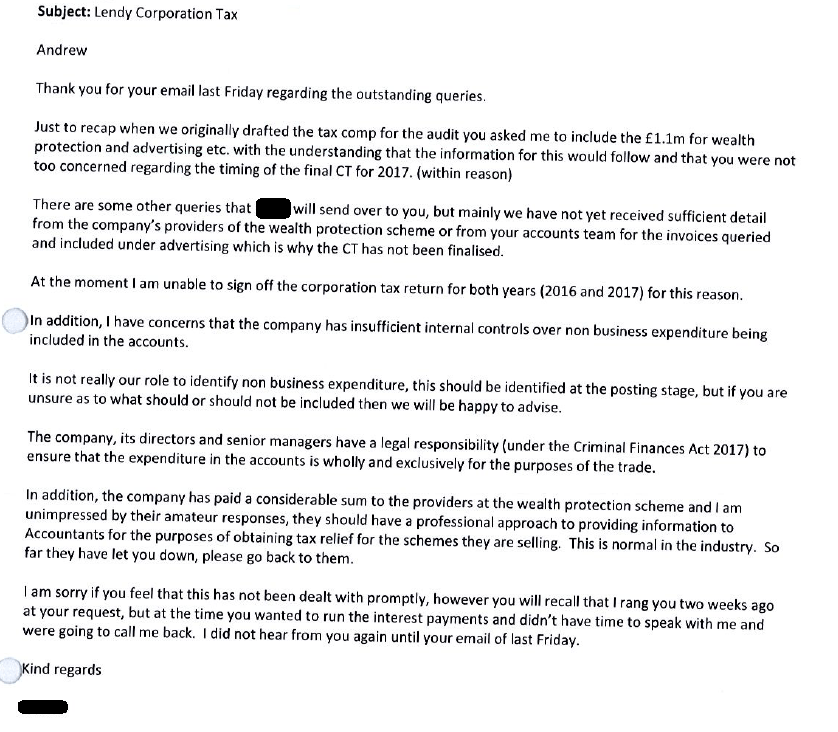

He said: “Liam Brooke refused to sign-off on the draft tax returns unless the tax adviser dropped her insistence that she must mention Liam Brooke’s involvement in a tax avoidance scheme, and the tax adviser was unwilling to meet Liam Brooke’s demand that she must amend the return to claim deductions for his expenditure on foreign hotels, supercars and helicopter lessons.

“When Liam Brooke asked for my help, I could see that Liam Brooke had made no attempt to justify those outlays as proper business expenses, and I invited him to do so.

“I told him that in abstract, those activities could conceivably have a business connection, but I didn’t know anything of the particular circumstances of his case.

“When I gave Liam Brooke some examples of theoretical cases, Liam Brooke simply passed those to Lendy’s tax adviser, telling the tax adviser that the situations I’d described were precisely the context in which these expenses had been incurred.

“I suspected that Liam Brooke was misrepresenting the truth of the matter, and I feared that I had become an instrument in Liam Brooke’s fabrication, but I’m afraid that I didn’t challenge him.”

He added: “When Liam Brooke later directed that Lendy should pay his wedding expenses and record the outlays as Lendy’s ‘marketing’ expenses, I didn’t criticise him; I merely advised the Financial Controller to record the items as a loan from Lendy.”

He also said Mr Brooke arranged for Lendy’s customer reviews on TrustPilot to be artificially manipulated to show higher ratings of customer satisfaction which led to the resignation of Paul Riddell, the head of communications.

Staff morale in the “laddish” Portsmouth office was poor as Mr Brooke referred to staff members as “ret**d” and “c**t”, he also claimed, with employees meeting in the car park to avoid being heard by office listening devices.

Mr O’Connor, whose job he said it was to build the business, says he was forced into accountancy work because much of Lendy’s lending records were “often incomplete or entirely missing”.

He said: “Staff told me that Liam Brooke had always been sensitive about showing the mounting volume of loans that remained outstanding for extended periods, and that he had directed steps to disguise the poor recovery prospects so as to create an image that Lendy’s lending record was much better.

“He had allegedly done this in a variety of ways:

“(a) Where loans remained in default for extended periods, Lendy had frequently disguised or erased the extent of that default by notionally “refinancing” the loan.

“The sum remained outstanding but the records of the original loan would be replaced by recording a “new” loan equal to the cumulative sum then outstanding.

“Because this was a “new” loan, it was within term and so it was suddenly not “due” for a further 12 months, or so. No money had ever been recovered for customers but, as if by magic, Lendy’s lending record looked much better because there were now fewer loans in “default”.

“(b) Liam Brooke had apparently resisted initiatives that would attempt to disaggregate loans that had been combined.

“Many individual loans had no unique identifiers and where successive advances had been made to the same borrower (such as staged advances over perhaps 24 months for a development project), there was often little or no detail recorded on the individual tranches: This kept Lendy’s lending records entirely opaque.

“Liam Brooke… made no secret that he was ‘just trying to get around the rules’.”

Mr O’Connor said, on 5 November, he met with the CEO and said he had refused money being moved from Lendy into Mr Brooke’s private companies.

He said: “This was the first time Liam Brooke had ever seen me trying to block his endeavours, as opposed to offering a solution that might facilitate them or an alternative. He was surprised and unhappy.

“He became red-faced and frustrated, and protested that there was no point in being in business unless one could keep the upside.“

Mr O’Connor claims he said before he left Lendy that the company should be honest with the FCA about Lendy’s capital adequacy and financial strength and any lies would lead to criminal consequences.

Saying he felt “intimidated” by Mr Brooke’s insistence no other disclosure to the FCA was needed, he said: “I explained that I couldn’t simply just “pretend” not to know about these things – and nor could he. I said I could present the information to the FCA in a “sympathetic light”, but that one way or the other, I was at risk, personally, unless I could show I’d taken all reasonable steps to ensure that the FCA were made aware of these things.

“I noted that misleading the FCA was a criminal offence.”

Concluding his witness statement, he said: “For my whole career, I’ve worked in the field of regulated financial services. The regulatory system requires an employee in that industry to demonstrate clean references in the prior six years in order to be offered a responsible role.

“Prospective employers are wary of offering me a role on news that I was disciplined and dismissed for allegedly lacking skills in financial management and compliance, and for allegedly worsening my employer’s relations with the FCA. No employer wants someone accused of those things.“

He added: “It has excluded me from regaining employment and cast a damaging slur on my professional reputation. It has been so damaging, and has taken so long to reach a judicial examination of all the facts, that I fear it has effected a permanent impediment on what should be the most rewarding time of my career.“

Mark Greaves, representing the 2nd respondent Lendy, said Charles Bellringer, a part-time consultant, had recommended Mr O’Connor should be dismissed.

Quoting Mr Bellringer: “My advice that Kieran should be dismissed was due to my experience with his behaviours and the breakdown of relationship with the FCA and certainly not because of any issues that he had raised with Liam, which I would not have been specifically aware of.

“I would not have held it against Kieran if he had raised concerns to me as I would have recognised it as part of his job as CFO.

“I understand that Kieran alleges that he was dismissed by reason of him raising apparent whistleblowing complaints with Liam. I deny that my view that Kieran should be dismissed and my advice to Liam that this was the appropriate decision was anything to do with any protected disclosures that Kieran may have raised.“

Mr O’Connor denied this and said he was dismissed due to how he said he would go to the FCA about the company.

Lendy’s representatives criticised Mr O’Connor for having never been a Chief Financial Officer prior to his appointment, but he said he had been “above CFOs” in his work history.

Mr O’Connor said: “In each of my roles, my role was to grow and mitigate possible risks. One of the possible risks is regulatory intervention.

“That was imposed for Lendy. Even though I didn’t hold the customer’s hands and make changes to the customer’s requirements I had to be vigilant that people that did was living up to the regulatory requirements. That was then my problem.“

During cross-examination, Mr Greaves read out a message on WhatsApp by Mr O’Connor that he had no interest in the “punters” putting their money in Lendy.

He previously said: “The difficulty we have, in valuing the loan book, is that we’re dealing with 000s of emotional individuals – not a bank or insurance company that recognises that it made a bad bet and wants to move on.

“We’re best to stick with your original thought, of standing in the market at a price. Some will give up and sell out to us. If we get enough, we can possibly force the rump into going with our plans. Need to be strategic.“

Mr Greaves said: “You weren’t concerned if those plans forced the ‘rump’ in doing something they didn’t want to, even if they suffered losses.“

Mr O’Connor responded: “My concern was acting within the guidelines. If we can do something, I’m very analytical, and I would put it to the people that make those decisions.

“If we could do something that would be good for the company, that is my job.

“If it was legally possible, and didn’t give rise to a regulatory risk, I didn’t have a problem with it.“

Mr Greaves at the tribunal also had criticisms for Mr O’Connor when he apologised to the FCA at a meeting where they wanted to discuss Lendy’s inability to recover customers money.

The former CFO said: “I had no idea how the miscommunication had come out but I had been the most senior person there.

“It was a dysfunctional company and my role was to mitigate risk.

“I didn’t know where we, as a company, had screwed up but I had apologised on behalf of the company.“

When asked if he recognised he was, in part, at fault during that meeting, he said: “Everything I saw was second hand and there were conflicting calls.

“It was a scramble. It wasn’t very dignified and we may have gotten some things wrong.

“There were checks and balances but it was a good faith effort.“

Mr Greaves also outlined why if he genuinely felt there was an issue why Mr O’Connor did not whistleblow to the FCA.

He said: “Do you accept there was nothing stopping you from going to the FCA at any point? You could have gone to the FCA when you were on garden leave.“

The claimant responded: “I could not. I was threatened by lawyers specifically the following Monday or the following Tuesday. They stressed the confidentiality requirements. I couldn’t speak to anybody. I took it as meaning I couldn’t say anything about Lendy.

“The FCA subpoenaed me in September 2019 and I probably had a five-hour interview with them. I mentioned that I had been made a scapegoat.“

The tribunal continues tomorrow.

Coverage

22/11/2021: Lendy CFO reported ‘serious financial irregularities’ before sacking, Tribunal finds

02/08/2022: Former Lendy CFO’s £6.6m Employment Tribunal claim begins

04/08/2022: Lendy: “It was a dysfunctional company”, tribunal hears on 2nd day

05/08/2022: Lendy was in “regulatory financial cardiac arrest”, tribunal hears on 3rd day

08/08/2022: CEO: Lendy was “in chaos…I found it a bit overwhelming”, tribunal hears on 4th day

09/08/2022: O’Connor “was responsible for knowingly misleading both the FCA and investors” tribunal hears on 5th day

10/08/2022: Tribunal rejects £6.6m claim but finds Kieran O’Connor was “a convenient scapegoat”

Case Details

Employment Tribunal Case No: 1400452/2019

London Central Employment Tribunal

Before Employment Judge Mark Emery

Sitting with Tribunal Members Jennifer Cameron and S Hearn

Claimant:

Mr K O’Connor

Respondent:

(1) Mr Liam John Brooke

(2) Lendy Limited

The Trust Pilot manipulation was blatant. Numerous damming opinions were challenged and removed.

LikeLike