The founders of failed peer-to-peer lending company Lendy were “wholly inappropriate” in calling investors punters after they sunk life savings into the business shortly before it entered administration, an employment tribunal has heard.

Today we heard how Kieran O’Connor allegedly said “lenders on Lendy’s peer-to-peer lending platform should be regarded as ‘punters’ who were taking risks that they should have known about.”

That the CEO and CFO “were good at giving abuse to people and that created a toxic environment”

And: “What is running through these submissions is not an innocent understanding of events but a fraudulent and conniving use of sham documents, making fraudulent misrepresentations, and deliberately disguised payments.“

Please donate to the Cheese Fund to support crowd-funded journalism of the P2P sector.

Contemporaneous Tribunal Reporting by Joe Morgan, additional reporting by Daniel Cloake.

Kieran O’Connor, 56, was slammed for “shirking” his role as CFO before he was dismissed and called lacking in financial management and compliance.

But he says he was made a scapegoat for CEO and director Liam Brooke’s conduct and that he was dismissed for threatening to whistleblow Lendy to the Financial Conduct Authority (FCA).

Mr O’Connor is pursuing a claim of unfair dismissal against Lendy Ltd, and a claim in respect of detriment against former CEO and director Liam Brooke, 40, of Southsea following the making of what are said to be protected disclosures.

The claims, which total £6.6m, include compensation for loss of salary (£750k), loss of bonus (£2.75m), and £36,100 towards “hurt feelings and embarrassment at the circumstances of my dismissal“.

The company entered into administration in May 2019, leaving over £160m outstanding on the loan book, with at least £90m of those funds in default.

It was said that Lendy also created “sham invoices” to justify movement of millions of pounds to offshore companies prior to failing, the remote hearing was told at the London Central Employment Tribunal.

Asset freezing orders were granted against Mr Brooke and Tim Gordon, 41, after the former Lendy directors were accused of lying to administrators about their relationship with companies based in the Marshall Islands.

A full report into the claims can be read in Lendy v Brooke & Others – The Marshall Island Mystery

Lendy Ltd and Mr Brooke deny Mr O’Connor’s claims.

Mark Greaves, representing Lendy Ltd, concluded his examination of Mr O’Connor today by asking if he had regretted any of his actions while CFO.

He said he had admitted struggling to manage Paul Coles, the Head of Compliance at Lendy, and his breakfast meeting with Mr Brooke where he informed the director of his plans to whistleblow.

He said: “The other thing I regret is I still wonder how my meeting with Liam on the 7th November could have been handled differently.

“I said, we have to make it clear to the FCA or you are at risk of criminal litigation. I said I might also be at risk purely because of my role as CFO.

“I said, FCA will find this out, and they did, and everyone is screwed.

“I do wonder what I could have done differently. Liam is a misguided young man. I got on well with him and he made some great decisions and it’s a great shame because we could have done a lot with the business.

“I do wonder if I had acted differently on that day. It led to a rash decision [dismissing me] and I wonder if we could have done things differently to avoid that.“

Damian Webb, one of the joint administrators of Lendy appointed in May 2019, was called as a witness to the tribunal because he had said Mr O’Connor’s role would have been made redundant once the company had gone into administration.

He said in his statement: “I believe the claimant’s role involved him seeking to raise capital and/or investment for Lendy, which was no longer necessary given the administration.

“I also understand the claimant was employed on a relatively high salary.

“Accordingly, if the claimant had still been in his role as Chief Financial Officer at the time of the appointment, I am certain that the Joint Administrators would have made him redundant shortly after our appointment, and almost undoubtedly within seven days.“

Part of Mr Webb’s role was also in examining how Lendy had not paid attention to the FCA’s VREQ (voluntarily accepting a variation of permission or the imposition of a requirement), essentially a payment restriction of amounts over £5,000.

Mr O’Connor said there had been 50 payments totalling up to £1 million between November 2018 and March 2019 paid to Mr Brooke and this motivated lawyers to ask the High Court to freeze the assets of Mr Brooke, which Mr Webb agreed was a breach of the VREQ.

He said: “Part of the submissions that your counsel made was that…sham documents designed to disguise the true nature of offshore payments, which were payments ultimately received by, and made for the personal benefit of, the directors.

“These payments which had been disguised by sham documents were made for the benefit of Mr Brooke.“

Quoting the High Court: “These payments were not made in exchange for services genuinely rendered, and did not amount to a discharge of sums genuinely owed,

“On the evidence that he has reviewed, he goes on after testing the submissions of the parties that the alleged dishonest conduct, and this is of Mr Brooke, involves deception and payments to offshore companies. The other allegations are made by lying about any payments in the offshore companies.“

Mr O’Connor also referenced lawyers who “denied Mr Webb indicated [Lendy] was likely to be solvent and a distribution made to shareholders“.

He said: “Liam is saying that you said to him that the company would be solvent and there would be dividends for the distributor, and your counsel is saying that is a lie.“

Mr Webb responded: “There was no statement along those lines.“

Mr O’Connor said: “So what Liam is saying was a complete untruth.“

The administrator responded: “Liam held the view the company was solvent at the time of the administration as part of the income from the loan book.

“It was technically insolvent as they couldn’t pay their debts.“

Mr O’Connor said: “What is running through these submissions is not an innocent understanding of events but a fraudulent and conniving use of sham documents, making fraudulent misrepresentations, and deliberately disguised payments.“

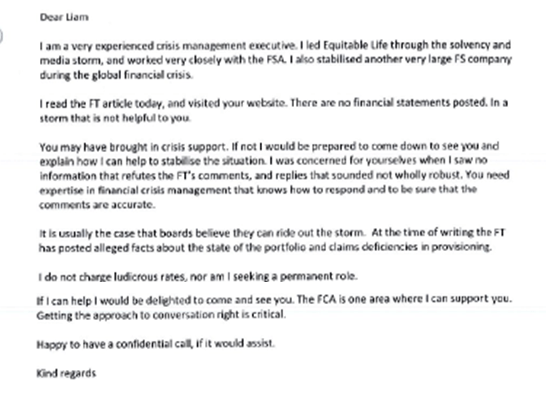

Charles Bellringer, 67, a chartered accountant and self-employed consultant specialising in financial services, was next called as a witness as he was considered an “influence” on the dismissal of Mr O’Connor and specialised on companies who had fallen foul of the FCA.

In his witness statement, he said he had offered his services when reading about Lendy’s issues in the FT and was quickly taken onboard as an independent consultant, which led to the FCA agreeing not to take any further action in October 2018.

He said he observed a growing number of issues coming in from the regulator about financial viability and caused “considerable stress within the business“.

In regards to Mr O’Connor’s whistleblowing, he said: “I certainly wouldn’t have regarded the fact of him raising such matters to be inappropriate or, indeed, matters that would cause him to be regarded as making trouble that in some way needed to be silenced.

“I spoke regularly with Liam during this time and he never mentioned to me that he had any concerns or issues about any matters, information or topics that Kieran was speaking to him about or, indeed, that he regarded Kieran as having raised some sort of whistleblowing complaints with him.“

In reference to the VREQ notification, he described that Mr O’Connor snapped at him and allegedly said, “I have nothing but contempt for people like the FCA and you. As far as I’m concerned people like you are in the gutter!“

Mr Bellringer said: “He was furious, shocked and highly agitated about the VREQ being provided. He suggested that Lendy did not need to comply because it was voluntary.

“In my opinion, this was not a fully informed view. It being referred to as voluntary is only a courtesy and it only remains voluntary for as long as the business is willing to comply.

“It can otherwise be enforced by the regulator as needed. After his outburst, Kieran then stormed out of the office and left the premises.”

He added: “My clear understanding of what was concerning Kieran at that time was the viability of the business, rather than treating customers fairly.

“Kieran’s views expressed to me on more than one occasion was that the lenders on Lendy’s peer-to-peer lending platform should be regarded as ‘punters’ who were taking risks that they should have known about.

“I believed that one of his primary concerns was that his discretionary [£500,000] bonus would not be paid if the VREQ was put in place.”

Mr Bellringer said there had been a letter authored by Mr O’Connor which contained what he believed “several inaccurate and potentially misrepresentative statements“, and an email exchange with the FCA about investors that was published without prior FCA approval.

He said Mr O’Connor’s background in hedge fund investment banking, as well as being concerned in his lack of a role as a CFO and not displaying a lack of empathy or treating customers fairly was “very concerning“.

He added: “Liam [Brooke] ultimately made the decision to dismiss based on my recommendations and advice from [lawyers] Stevens & Bolton LLP.

“My advice that Kieran should be dismissed was due to my experience with his behaviour and the breakdown of relationship with the FCA and certainly not because of any issues that he had raised with Liam, which I would not have been specifically aware of.”

Mr Bellringer made criticisms of Mr O’Connor for not spending his time correctly while Lendy was in “crisis mode“.

He said: “There are different styles of CFO, and I coach CFOs so I know something about this, and that some take a hands off approach and allow information to be sent beyond them and some are very involved.

“I have an approach in that, there are simply times I would have to put my neck on the block and I decide whether I need to do that and no one else will decide when I do this.

“In this case, the information I received was that the CFO should be extensively involved in the preparation of the information and therefore be comfortable with the information that goes to the FCA.”

Mr O’Connor retorted: “But if the CFO is not comfortable, then that’s a real issue.“

Mr Bellringer said he felt as a “former senior manager” that he owed [former head of compliance] Mr Coles more of an obligation as his line manager.

He said: “I do not think you or Mr Brooke were necessarily very involved. You were good at giving abuse to people and that created a toxic environment which started before you arrived.

“You can see how you are described to people. You’re not a compromising person. You’re very forceful in your views and that led to problems with Mr Coles.“

Mr O’Connor however said this was “completely not true” and called it a “false allegation“.

Evidence then moved to the last days of November 2018 which Mr Bellringer called a “very urgent and fast moving difficult situation“.

Mr Bellringer said: “I was appalled by your conduct on 6 November. You did say, whether you like it or not, that people like and FCA are in the gutter. I was shocked.

“From then I had discussions with [employment lawyers] because I knew one of the partners who I respected a lot and was able to give advice. The [words] are engraved on my memory to this day.“

Mr O’Connor read out a quote from an email written by Mr Brooke that accused Mr Bellringer of “jumping to the wrong conclusions very quickly on many occasions on imperfect information“.

Mr Bellringer said in response: “This was crisis management. You have to act very rapidly and not every judgement will be perfect.

“The company was in regulatory financial cardiac arrest. We need to understand that. Decisions cannot wait days.

“You cannot wait for sign offs and you have to take some risks.

“Yes, you do act in cardiac arrest with imperfect information and that is part of the job. You have to be as footsure as you can but won’t have all the opportunities to have all the information that you can.

“Rarely in consultancy do you have all the information.“

Mr O’Connor also accused the accountant of having a “recurring bias” against anyone with a banking background.

He said: “In regards to the statement on 6 November when you called investors punters, saying ‘punters’ is gamblers.

“You spoke this morning of mums and dads and children investing in their properties. I would have thought a lot of people were nearly retired people who were requiring these funds to do well to secure their retirement.

“For you to call them punters who gambled away on a risky bet I say that it is wholly inappropriate.

“Yes, with any investment, you need to be aware of the risk that they’re taking.

“But like the letter you drafted in October to go to investors clearly did not give a balanced and full view.”

He added: “His first priority [as CFO] was to look after the retail customers and they were not treated with the right consideration.

“His attitude to them and to risk did not really mirror the risk profile that retail investors would expect.

“Treating customers fairly has to be at the centre of your thinking.“

Mr Bellringer added: “You seem to shirk your responsibility as one of the most senior executives in the business.

“There is a model for executive behaviours – on one hand there is passive, in the middle those who are assertive, and on the other who are aggressive.

“A lot of the time you passed from assertive into aggressive, and you were very coercive in your style.

“I know from other people’s comments to me and no I will not tell you their names.”

After Mr O’Connor laughed, he said: “I don’t find it amusing and this is something I thought about very thoroughly. You have a very assertive character and went past it and these people didn’t stand up to you.”

Disagreeing with the consultant, Mr O’Connor: “What matters is who was making the decisions. It doesn’t matter about your general thoughts of who was a nasty person or a forthright person, what matters is when you read a High Court judgement that applies forensic detail and you see Coles gave a false assurance to the FCA and then reneged on that.”

Mr Bellringer said: “It doesn’t matter to me whether you are a nasty person or not, it’s about whether it was appropriate for you to be involved in the business.

“While business is in cardiac arrest you were still focusing in trying to raise funds which was part of your terms of reference but when you’re in cardiac arrest this business can’t raise funds so it was an academic exercise.

“I said you should be involved in some of these crisis issues and it was delegated to me.

“I didn’t have access to all of the information [as a consultant], I don’t expect you to have it all but I had less of it.

“I formed judgement views based on what I knew and the information I had.“

Mr O’Connor responded: “Mr Bellringer is well meaning but he forms views on could they play a role in the business. I don’t disrespect that.

“Some people have fervent views and act not on fact but on their own view.“

He added: “My case Mr Bellringer was a very influential person and he put forth a very positive and uncompromising statement to the FCA.

“Mr Bellringer says he cannot be responsible for that but he knew that he was very influential on Liam at the time.

“I’ve alleged that a lot of what Mr Bellringer has based his decision on is unsubstantiated.“

Lendy and Mr Brooke deny Mr O’Connor’s claims.

The tribunal continues next Monday.

Coverage

22/11/2021: Lendy CFO reported ‘serious financial irregularities’ before sacking, Tribunal finds

02/08/2022: Former Lendy CFO’s £6.6m Employment Tribunal claim begins

04/08/2022: Lendy: “It was a dysfunctional company”, tribunal hears on 2nd day

05/08/2022: Lendy was in “regulatory financial cardiac arrest”, tribunal hears on 3rd day

08/08/2022: CEO: Lendy was “in chaos…I found it a bit overwhelming”, tribunal hears on 4th day

09/08/2022: O’Connor “was responsible for knowingly misleading both the FCA and investors” tribunal hears on 5th day

10/08/2022: Tribunal rejects £6.6m claim but finds Kieran O’Connor was “a convenient scapegoat”

Case Details

Employment Tribunal Case No: 1400452/2019

London Central Employment Tribunal

Before Employment Judge Mark Emery

Sitting with Tribunal Members Jennifer Cameron and S Hearn

Claimant:

Mr K O’Connor

Respondent:

(1) Mr Liam John Brooke

(2) Lendy Limited

Thanks for the work

LikeLike