The Employment Tribunal has rejected a £6.6m claim that the former CFO of failed Peer-to-Peer finance firm Lendy was unfairly dismissed or suffered detriments.

Please donate to the Cheese Fund to support crowd-funded journalism of the P2P sector.

Reporting by Daniel Cloake.

Mr O’Connor was pursuing a claim of unfair dismissal against Lendy Ltd, and a claim in respect of detriment against former CEO and director Liam Brooke, 40, of Southsea following the making of what are said to be protected disclosures.

The claims, which total £6.6m, include compensation for loss of salary (£750k), loss of bonus (£2.75m), and £36,100 towards “hurt feelings and embarrassment at the circumstances of my dismissal“.

The company entered into administration in May 2019, leaving over £160m outstanding on the loan book, with at least £90m of those funds in default.

The full judgment, as read out earlier today, follows below but in short – the tribunal found that “the FCA had significant concerns about massive failures involving [Lendy] which far predated the claimant’s arrival at the firm“.

The tribunal found that “the company had adopted a view that it was pin to as much blame of this onto the claimant” making him “a convenient scapegoat“.

In any event “by the end of October 2018 the claimants role was effectively redundant… [Lendy] was no longer a company with any real future, it need skills involving FCA crisis management that were not … in the claimants forte.“

The tribunal did have “really significant concerns about the dismissal letter“. It was ruled that Mr O’Connor “had landed in an impossible position in taking this role. The letter to the FCA [criticising him] and letter of dismissal did not fairly reflect the difficulties he faced.“

O’Connor was told “critically you were not made aware of serious legal issues affecting the company which had been known of by Mr Brooke but which no one choose to tell you about. We consider one of the reasons why you were kept in the dark was that the company was dysfunctional with competing managers interests and silos of information“.

The Tribunals Extempore Judgment

We have reached our Judgment.

Mr O’Connor you have not been successful in your claims, we find no link between your protected disclosures and the detriments you have suffered; however, we do have significant criticism of how you were treated by Brooke and Lendy, particularly the manner of your dismissal and the reasons you were given. These factors form part of our judgment.

Facts are as follows, you were seen as a highly effectively employee, tasked with more and more duties and responsibilities during your short employment, including supervising others, you were seen as a step above the other employees in capability and the efforts you put into your role.

Mr Brooke remains highly complementary and impressed by your capabilities. As you got more and more responsibilities, critically you were not made aware of serious legal issues affecting the company which had been known of by Mr Brooke but which no one choose to tell you about. We consider one of the reasons why you were kept in the dark was that the company was dysfunctional with competing managers interests and silos of information.

Also, Mr Brooke considered you as the last chance to rescue the company but you wouldn’t be motivated to do so if you were aware of such systemic legal issues. We refer to Feb ‘18 legal advice which said that Lendy may not be entitled to interest payments from which it was taking income.

There were therefore significant and existential issues affecting the business which were kept from you…The implications for Lendy’s regulatory standing was significant.

So, when did you find out about the issues affecting the company?

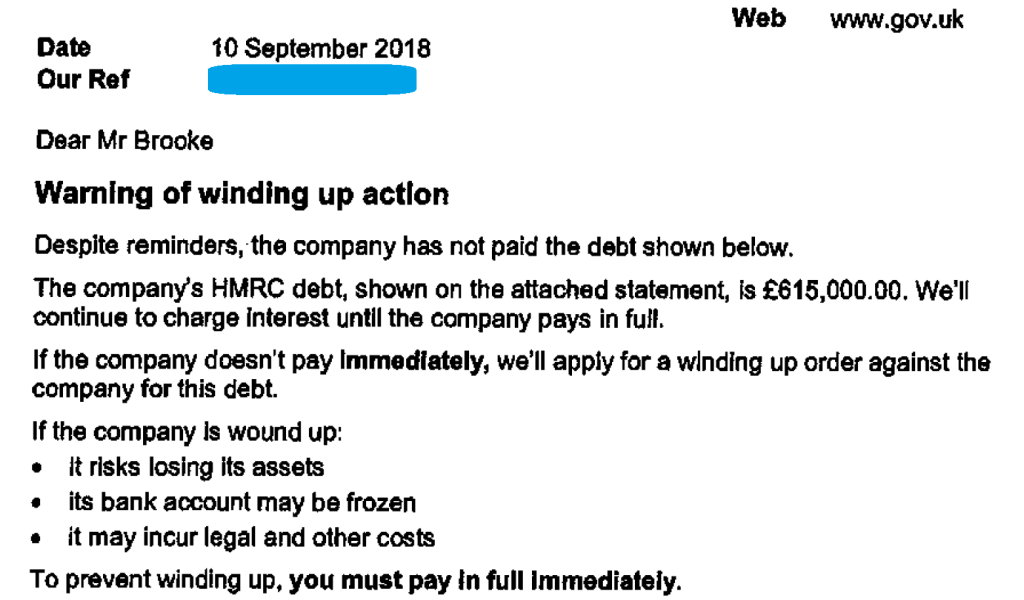

The first red flag was the September winding up letter and you were told about the issue of retained interest. While there may have been competing legal advice you considered the issue yourself and, having worked out the seriousness of the issue realised there was a real problem. However, you were told that you were wrong, that there was competing advice and lawyers were dealing with it.

So, in conclusion there was a lack of disclosure to you on serious issues you should have been told about. It’s quite unreasonable for the respondents not to have disclosed that to you.

The Homer Row litigation then raised itself, again you had not been appraised of the background. The risk was that peer-to-peer lenders were on the hook, not just the agent, something that nobody had previously foreseen.

There was an exchange of views among the respondents, driven by the claimant and the lawyers, it was O’Connor who suggested that the borrowers claim has no merit, in the letter to the FCA. The lawyers disagreed saying the claim is arguable and therefore has merit.

The documents show that at this time you were driving this response, there was a difference of opinion of how much the FCA could be told. You decided to rewrite the letter to the FCA, and say the claim had no merit. Some members of the team objected to the letter and others said it was fine. You were dismissive of the letter.

Mr Brooke agreed to the contents of the FCA letter, it was sent as a privileged and confidential to the FCA.

In a conference call with the FCA the following day there was a significant issue with the sound quality. You say you didn’t receive the letter that followed from the FCA. We disagree because we can see that the 25th September letter, timed 21.06, was sent to you all via external lawyers on 26th September.

You say you didn’t hear the call mention that prior authorisation was required before information could be released and what information could be sent to the lenders, we think you were careless about what you heard, if there was bits you had not heard you should have checked with colleagues. In any event you then drafted an introduction to a 50-page-report which has been sent to investors in the litigation. It says “the claim is vexatious, claim has no merit and recommendation was the claim should be rejected.” It attached the privileged and confidential letter from the FCA.

The FCA was critical because the report was not sent to it at the time, the comment that the claim had no merit, and that the letter to the FCA was sent. The FCA summary was written by the claimant was not with the best interests of the investors in mind. We accept Mr Bellringer view that the claimant should have known a a privileged and confidential letter should not be sent to investors.

We accepted that he should have known this fact.

We noted that Mr Brooke’s letter about the difference between the commercial and compliance issues, while compliance is important sometimes you have to make a commercial choice.

You and Mr Brooke were on the same page, and it was Mr Brooke’s enthusiastic response which was indicative that he felt the report should be sent as written, including your summary. We consider that a decision was given to give this one last shot to save the company and play a hard commercial game. This was a commercial decision which did not take into account the response of the compliance department. Mr Brooke was the approved person and it was his obligation to ensure the letter was appropriate and he did not do so however we also consider the claimant was also acting far beyond the actions of a CFO in a retail P2P lending company.

We also learnt the FCA expressed its dissatisfaction at the claimants conduct at the 10th October meeting. All parties worked hard to file a report to the FCA by 22nd October.

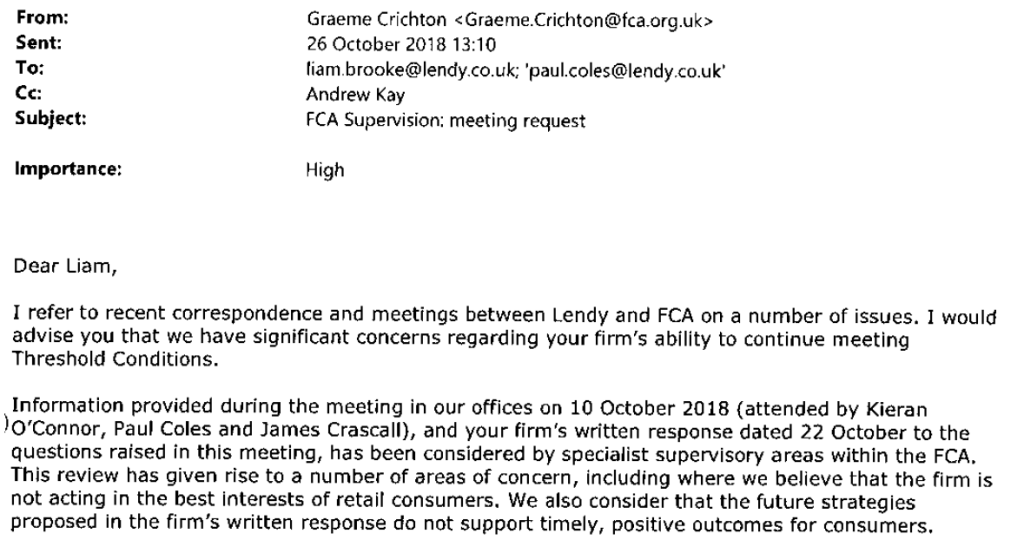

The FCA’s response was, we consider quite illustrative, it shows the FCA have systemic and wide-ranging concerns about the major issues involved with the company the threshold conditions, the appropriate resources, suitable conditions, it says information was provided in the meeting and the response give rise to a number of areas of concerns including if Lendy was acting in the best interests of retail consumers

The FCA wrote 13 bullet points setting out its concerns. Two or three include the claimant. Two relate to provision of information to the FCA

Our view is the FCA had significant concerns about massive failures involving the second respondents which far predated the claimant’s arrival at the firm, some of these as already mentioned the claimant had not been appraised of.

We also accepted at the 30th October meeting the FCA was critical of the claimants conduct. However as above we find this a very small part of the systemic issues the FCA had with Lendy and was one of very many concerns.

We accept that following this meeting Mr Brooke was of the view,. given the criticism that had been made of them by the FCA, that Mr O’Connor was likely a liability in the respondents dealing with the FCA.

We also accepted that by the end of October 2018 the claimants role was effectively redundant, that the 2nd respondent was no longer a company with any real future, it need skills involving FCA crisis management that were not we felt were not in the claimants forte.

On 6th November the respondent received the VREQ [FCA restriction], this was catastrophic, the claimant had also found out the day before about the February 2018 QC’s advice about the retained interest issue. This was all very bad news for everybody concerned that some of this information that was only now finding its way out.

In this context we found the claimant did make an outburst, Mr Bellringer was concerned about this.

The next day there was meeting, on 7th November the claimant gave information and said it should be sent to the FCA, about the retained interest issue. The preliminary hearing judgment deals with this. We accept that to Mr Brooke this issue was nothing new. It’s incredible that to Mr O’Connor this QC’s advice was new information. We accept he was agitated and pushed for information.

We need to ask, bearing in mind the criticisms we have of the company whether disclosures made any element in the claimants dismissal. We concluded that they did not because by the 5th/6th November a decision had been made by Mr Brooke following criticism by the FCA, it was convenient to pin as much as possible on him.

In effect we found he was a convenient scapegoat. On 6th and 8th November 2018 Mr Brooke and Mr Bellringer decided he was not the right fit. We do not feel his conduct was reprehensible on the 6th November given the context.

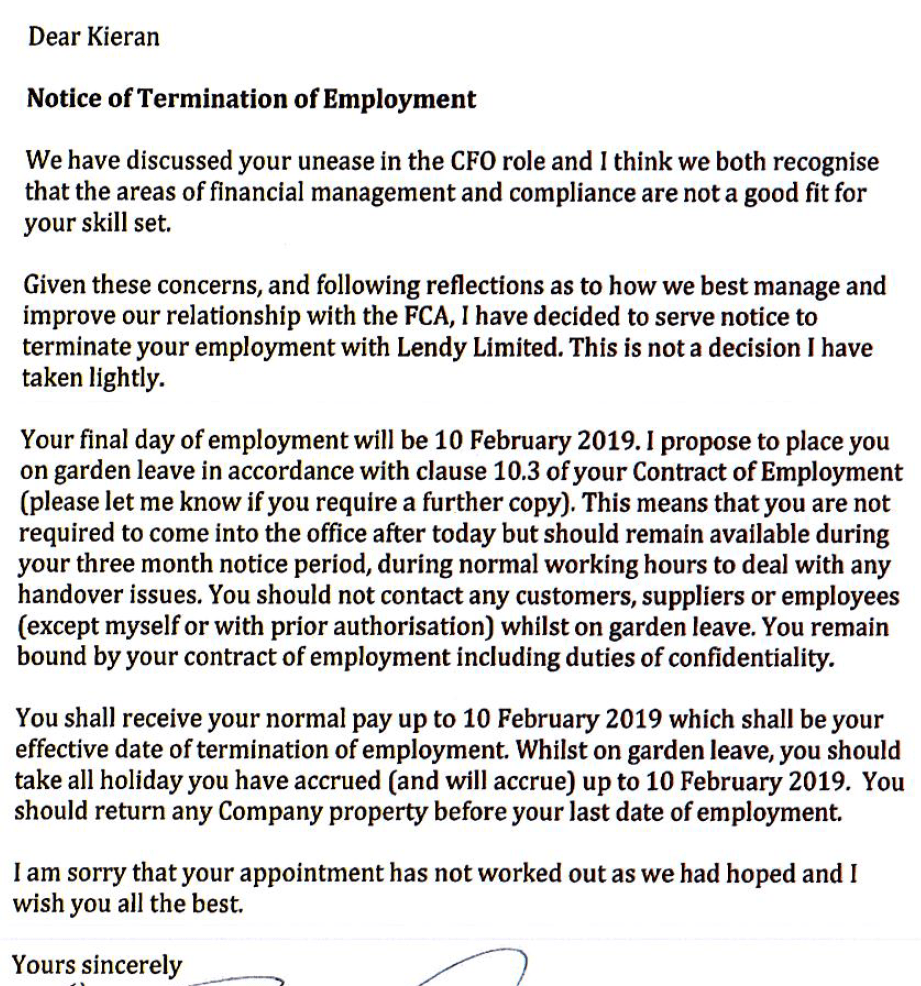

We had really significant concerns about the dismissal letter.

It says the claimant had financial management issues. We feel this is not fair at all. The second paragraph deals with about how best to manage Lendy’s relationship with the FCA.

We considered what a reasonable future potential employer with some knowledge of went on, what would they think of this letter. In context we felt it was excessive in effectively holding him in part to account for the issues that have faced the second respondent when in fact one of the significant issues was the claimant had not been kept up to speed with the issues. The claimant had done some things wrong – on sending incorrect information to lenders, but that was information that was also signed off by Mr Brooke.

Mr Brooke and Lendy bare more culpability for what went wrong than he did.

So why ask for the reason for dismissal and was this related to his protected disclosures. No we felt it was the ill-judged comments, described as a throwaway comments, which was made to make sure that so far as the response concerned it had addressed the problems at the company.

So in other words while the reference is unfair and unreasonable it wasn’t a detriment.

The reason why no process was had, was not because he was a whistle blower but the decision had been made and the claimant had no statutory right to claim unfair dismissal. Given the contents of this dismissal letter we think this was wholly wrong. It should have been put to the claimant what the issues were and he should have been given an opportunity to put his points of view as to why his dismissal letter should not say something else.

We fail to see why the claimant could not be made redundant. Yes there were criticisms, yes it made things clear, but the company had adopted a view that it was pin to as much blame of this onto the claimant.

The issue was not his suitable to run a retail financial services company, it was his suitability to run a company in this chronic situation when he hadn’t been given information throughout. The claimant had landed in an impossible position in taking this role. The letter to the FCA and letter of dismissal did not fairly reflect the difficulties he faced.

We did not think failure to pay bonus was a detriment, whilst we are not dealing with a breach of contract claim it appears us to us there is no contractual entitlement for the sum. The basis upon which and the triggers for which hadn’t been met. The supervening event for getting finance was not satisfied by the provision of an overdraft facility.

The last issue to deal with are the fact the claimant was excluded from meetings on 7th November and excluded from a call with the FCA. Again, we don’t think these are related, a decision had been made to dismiss the claimant for reasons that have been made and the claimant was excluded from those meetings because the decision had been taken.

That’s the basic summary of reasons for dismissal.

END

It’s not known if any aspect of this decision will be appealed.

Coverage

22/11/2021: Lendy CFO reported ‘serious financial irregularities’ before sacking, Tribunal finds

02/08/2022: Former Lendy CFO’s £6.6m Employment Tribunal claim begins

04/08/2022: Lendy: “It was a dysfunctional company”, tribunal hears on 2nd day

05/08/2022: Lendy was in “regulatory financial cardiac arrest”, tribunal hears on 3rd day

08/08/2022: CEO: Lendy was “in chaos…I found it a bit overwhelming”, tribunal hears on 4th day

09/08/2022: O’Connor “was responsible for knowingly misleading both the FCA and investors” tribunal hears on 5th day

10/08/2022: Tribunal rejects £6.6m claim but finds Kieran O’Connor was “a convenient scapegoat”

Case Details

Employment Tribunal Case No: 1400452/2019

London Central Employment Tribunal

Before Employment Judge Mark Emery

Sitting with Tribunal Members Jennifer Cameron and S Hearn

Claimant:

Mr K O’Connor

Respondent:

(1) Mr Liam John Brooke

(2) Lendy Limited

5 thoughts on “Tribunal rejects £6.6m claim but finds Kieran O’Connor was “a convenient scapegoat””