A jury at Southwark Crown Court has heard statements from members of the public, including a retired chartered accountant, who say they only invested using the platform because of its apparent FCA authorisation.

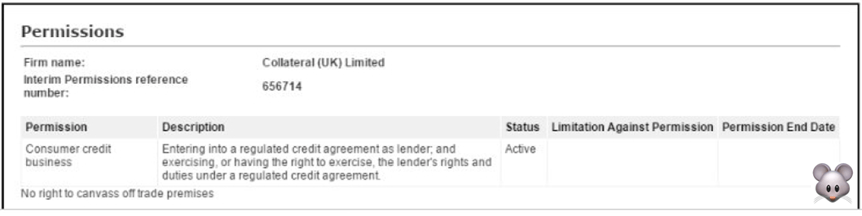

The FCA claim the platform only appeared on the FCA register after a director fraudulently changed an unrelated company’s entry, a mistake that one investor says wasn’t picked up for almost two years. The directors deny any wrongdoing.

Collateral (UK) Limited was a finance company which facilitated investments crowdfunded by members of the public. The firm and two related companies entered administration in April 2018.

The two defendants, Andrew Currie, 57, and Peter Currie, 59, both deny two charges under the Fraud Act 2006 and one charge under the Proceeds of Crime Act 2002 in this criminal prosecution brought by the Financial Conduct Authority.

For further information about the case, and to see our reporting of other days please visit our main trial information page.

Coverage of this trial has been generously funded from donations to our gofundme page. Please consider adding an amount to support crowd-funded journalism of the peer-to-peer lending sector.

Contemporaneous reporting by Alex Varley-Winter who tweets @avwinter. Edited by Daniel Cloake.

Today will be focused on prosecution evidence from investors in Collateral (UK) Limited.

The judge explained to the jury that if there were no actual questions for the witnesses then sometimes the prosecution will still call the witness to court just so that they can see the person.

Otherwise – “the statement can be read out” and indeed barrister Thomas Coke-Smyth, representing the Financial Conduct Authority, took the jury through the investors’ witness statements.

Notes from the statements as they were read out in court, with some abridgements by lawyers:

STEPHEN TOOLEY, 14 May 2021

Stephen Tooley gave a witness statement to the FCA on 14 May 2021. He is a company director who and first became aware of Collateral (UK) Limited from their marketing, including on the ‘Peer 2 Peer Independent Forum’.

Mr Tooley says he was looking to invest in a company “that was authorised and regulated by the FCA” having “lent funds through several other authorised FCA platforms.”

As Mr. Tooley understood it, the Collateral business model was that the website acted as an intermediary between lenders and borrowers who wished to use the platform, either to borrow money or to make loans and draw down interest on them: “At that point in time my impression was that the funds would be available to me, either to draw interest, or invest…”.

“I was under the impression that if a borrower defaulted on a loan, Collateral would have ensured that the security was in place,” he said. “I also drew comfort from the fact that Collateral claimed on the website and at the bottom of every email “Collateral (UK) Limited is authorised and regulated by the Financial Conduct Authority.”

“I don’t have access to the list of loans that I had [because] the Collateral website shut down without warning.”

“I made all payments prior to the 24th May 2017 … I received regular emails and lending confirmations … I have kept a few.”

[Barrister Thomas Coke-Smyth then took the jury through these exhibits]

“I’ve been asked by the FCA whether I thought Collateral was an FCA authorised firm, and as outlined I took comfort from that … it clearly stated the fact on their website and at the bottom of every email I received from them.”

“At some stage I don’t have a record of exactly when, I took a screen grab of the Interim Permissions Reference.“

“I can also confirm that I would never have entered into a loan agreement with Collateral if I’d known that their claim to FCA authorisation was untrue.”

“I”ve made a claim to the relevant insolvency practitioners providing proof of investment … £34,000 plus interest … that is obviously a very significant sum of money.”

“Further to my earlier statement … a screenshot from the FCA website showing that Collateral held interim permission.” – he believes this was taken in early February 2017 – “unfortunately I always assumed that I’d be able to access my information on the Collateral website and was shocked when it was suddenly taken offline.”

DR STEVE WOZNIAK, statements of 2021 and 2022

The jury then heard from the statement of Dr Wozniak, a retired research scientist. He says that “over the last decade I became an investor in Peer 2 Peer lending.’

Dr Wozniak’s statement describes how he invested in a few different peer to peer platforms including Zopa as early as 2010. One of the projects he was investing in on MoneyThing (another peer-to-peer lending firm) was then transferred to Collateral, which introduced him to the platform.

It was a ‘large building development’: “I’d invested in this project, in effect I followed that loan.”

“My understanding of the contract I entered was that Collateral would act as an authorised agent.”

“I believed that Collateral was authorised because of statements made by them on forums” – and on email footers, and in their Terms and Conditions.

“I have over a hundred emails dating from 2017 when I joined Collateral“

Dr Wozniak explained that the listing on the FCA register stated ‘interim permission’, a phrase used in several internet postings by Collateral staff.

“During the many decades that I’d been an investor I played safe … the P2P sector grew after the financial crash of 2008” – when the banks stopped offering loans – “I wouldn’t have been interested in Collateral (UK) Limited if I’d known that they weren’t authorised.”

On the platform were “building development loans and bridging loans for property, houses and flats, jewellery and watches …”

“I probably had over £200,000 invested at one time in Collateral .. the total of all my investments was I believe over £250,000. … I probably received several £thousand in interest.”

“It seems that the FCA failed to pick up on the false entry over a period of 22 months.”

In a second stsatement, Dr Wozniak clarified how much money he had exposed in Collateral (UK), from 11 May 2017 to 28 December 2017 — the total he says he invested was around £160,000.

“I did withdraw a little money from Collateral, around £6000.”

Wozniak’s exhibits included the ‘RISK WARNING’ text given to investors and detail such that the interest being offered on the loans was 14%.

SURESH PATEL, 11 March 2021

Barrister Thomas Coke-Smyth read the statement of Suresh Patel:

“I’m making this statement to describe my dealings with Collateral, a peer to peer platform. I was an investor with the platform from 2016 until it was put into administration in 2018, at which point I was owed approximately £100,000. I’m a software engineer and I’ve worked in education, and health care, for approximately 26 years.“

The jury was told that Mr Patel had started investing in 2016, initially testing the platform by investing a small amount of money (£15). “I increased my investments as returns came in from loans.”

In Feb 2017 “I arranged to visit the office of Collateral, I wanted to see if they were actually at the office in Manchester and if they wanted or needed any technical help. I met Peter and his brother Andrew and we discussed a loan arrangement.”

He said “I believed I was investing in secured loans and I always sold when the loan was near its term.” … “as so much time has passed I cannot recall what I invested in and on what date, this will be in Collateral records. … Collateral stated that they were authorised by the FCA, this appeared in emails and on their website, this made me feel safe about my investments …”

“If I thought Collateral were not FCA authorised I would not have entered into any loan agreements.”

CLAYTON DAVIS – 30 Apr 2021

[The mouseinthecourt is awaiting confirmation of the spelling of this name. We apologise if it’s misspelt]

“I’m a retired person, prior to that I worked as a manager in the IT industry. I first became aware of Collateral when I received an email from them however I’ve not retained the email. … following my research I loaned the sum of £6500 via the Collateral platform, which was to go to various borrowers regarding different projects.”

“Following the investments that I made on the platform I never received any returns either via interest payments or via capital payments. Prior to this happening, Collateral went into administration, I’m waiting for any returns that I may receive following administration but this is taking a long time.”

“I thought the firm was authorised and … under the FCA’s jurisdiction.“

“I wouldn’t have entered into the loans that I did, did I not think that Collateral was an authorised firm.”

“I haven’t retained any of the emails that I received from Collateral.”

SANDRA SNOWDON

Sandra Snowdon – a retired chartered accountant, gave a detailed statement on how she researched Collateral prior to trusting them with her money. We have abbreviated parts of her statement read to the court:

- She researched Collateral’s reputation on the P2P Independent Forum where in 2016 they were the fourth ‘most preferred company’ (31 votes) in and in 2016 the second ‘most preferred company’ (92 votes).

- She looked at Peter Currie’s biography, that he had a background in pawnbroking and ‘founded Collateral (UK) Limited in 2014.’ He had ‘liaised with the Office for Fair Trading and Trading Standards to obtain the required Consumer Credit Licenses.’

- Andrew Currie was listed as Business Development Manager.

She said “I also received a personal recommendation from another investor. Collateral was listed on the FCA register … with active interim permission.”

Coke-Smythe explained that: “All of the emails that she received had the statement about Collateral being authorised and regulated.”

Her exhibits include the terms and conditions that were displayed on the website.

She also included screenshots of discussions on the P2P independent forum:

One, we’re told, said “hi Collateral rep. Any news on the progress of full authorisation, and when we can expect an [innovative finance ISA] . Is it likely to be this year?”

On 18th Jan 2018, we’re told that someone at Collateral (UK) Limited replied: “hi Des, our application is still ongoing.”

A forum user called Nick says “I’m considering whether to start lending on your platform.” – he’s checked the Interim Permissions Consumer Register and notes that they have a consumer credit license but not one for ‘peer to peer’ lending.

On Jan 19th 2017, a Collateral representative replies that “yes we are currently under interim permission” and that “our lawyers and compliance officers are comfortable”.

Sandra had been reading those posts and took screenshots.

She said: “I wouldn’t have invested at all if I’d known that they were operating without regulatory permissions. If I’d thought that Collateral weren’t authorised by the FCA, I wouldn’t have entered into any agreement with them.”

Further, that she believed that their role was to offer “investment opportunities to lenders and do due diligence on the borrowers”, with risk assessments and “controls … in place”, to offer “administration and recovery of loans.”

She also used the site’s secondary market for buying or selling loans. All of the money that the website held would, as she understood it, “be held securely and segregated in a client money account.” Further, a separate company called “Collateral Security Trustee Limited acted as a security trustee”.

She believed that: “In the event of default, the platform would manage the process and sell the security [in order to repay the loan].”

“There was a risk warning on the website, Asset Backed Lending is not covered on the FSCS [financial services compensation scheme]” so her “main worry was about loan default.” As a result she says she tended to ‘sell loan parts on the secondary market’ for loans that “never exceeded 70% of the asset value.”

“When collateral entered administration I was owed £49,580.07”

Barrister Thomas Coke-Smyth said “she was registered on the platform on 12 April 2017, gradually increasing her investments until the platform [shut down] in February 2018”.

IVAN ZHIZNEVSKII

The court was told that Mr Zhiznevskii was a director of an investment company called 3S Investments Limited. it was explained that 3S ran a ‘UK peer to peer high income fund’ which is ‘registered with the AFM [as] required by Dutch law.’

It was said that when he heard about Collateral he “reached out to the firms directors requesting a face to face meeting” which took place on October 19th, 2017.

At the face to face meeting they met Andrew Currie and his brother Peter Currie.

The meeting covered ‘the regulatory status of Collateral’ as well as the firm’s loan book.

“At the time of us joining, Collateral appeared to be a rising star of peer to peer lending” – including an “attractive yield“, and an “opportunity to diversify at a strategic level“.

Collateral “stated on the firm’s own website that Collateral (UK) Limited operated under interim permission from the FCA” and “full authorisation was imminent.”

He compared the company to another lender well-known in the Peer2Peer sector: “Lendy were in the same position, i.e. actively trading while awaiting full authorisation.”

The actual lack of authorisation would have had “a fundamental effect on our decision to invest.”

“It’s part of our due diligence to check the firms status, on the FCA’s public register website.” If he had known that the company was unauthorised “we would not have invested with Collateral as this would have been a breach of the investment strategy.”

When the website shut down, “the total invested in loan parts was £17,924.”

And the overall total they had invested, we were told, was £196,352.

“The investment was presented to me by Andrew Currie on the basis that Collateral was interim authorised,” and “that they were expecting full authorisation in due course”. Mr Zhiznevskii said he beleived that Collateral would “conduct due diligence on prospective borrowers“

“if a deal was taken up by lenders the firm would advance cash to the borrowers on behalf of the lenders, the firm would then … enforce against the borrower if necessary.”

He believed that there would be:

- “full disclosure”

- “segregation of funds”

- “server backups.”

Mr Zhiznevskii explained that up until the time that the firm went into administration, he had access to the platform including lender capital and statements.

MATTHEW GRACE – 2020

The statement of Mr Grace explains that he is a consultant in financial services. “I came across Collateral doing searches on Google” and understood it had ‘interim permission’.

“I never would have invested in Collateral If I had known that their permission was for a separate company, that never covered Collateral.”

Mr Grace says that when the platform went down, the amount that he had invested totalled £54,533.53

He says he “knew it was outside the [financial services compensation scheme], I only communicated [with the company] via email, I like to have all communications recorded.”

Barrister Thomas Coke-Smyth told the jury that he was “not going to go through all of those emails, but let’s just look at the index for an example.”

LAWRENCE SAMUELS

“I’m a finance blogger.” who had put a small amount of money in, around £200, to research the company.

“I’ve been asked whether at the time of conducting my research, whether I thought they were authorised by the FCA. I wouldn’t have entered into any agreement [if they weren’t]”

DAVID BOWNDS

“I’m a retired person, before retiring I worked as a government official. … I first became aware of Collateral through online research, following my research I formed the impression that Collateral was trustworthy.”

The jury were told he registered with Collateral in August 2016, and made 57 deposits, with spreadsheets to keep track.

As of 5th February 2018, we were told he had £37,908.80 invested in the platform in jewellery, vehicles and property.

He can’t remember if he spoke to anyone at Collateral. “The fact I thought that Collateral was already registered by thh FCA was the most important factor.”

[Court adjourns]

The trial continues.

Case details:

Court 12 Southwark Crown Court

Before His Honour Judge Griffith

21st April 2023

Case number: T20220056

CURRIE Andrew

CURRIE Peter

The Financial Conduct Authority are represented by barrister Stuart Biggs, assisted by Thomas Coke-Smyth.

Peter Currie is represented by barrister Colin Aylott KC, assisted by Ashley Hendron.

Andrew Currie is represented by barrister Henry Grunwald OBE KC, assisted by Oliver Renton.

The work on this site is protected by copyright laws and treaties around the world. All such rights are reserved.

You may print off one copy, and may download extracts, of any page(s) from our site for your personal use and you may draw the attention of others within your organisation to content posted on our site.

You must not modify the paper or digital copies of any materials you have printed off or downloaded in any way, and you must not use any illustrations, photographs, video or audio sequences or any graphics separately from any accompanying text.

Our status (and that of any identified contributors) as the authors of content on our site must always be acknowledged.

You must not use any part of the content on our site for commercial purposes without obtaining a licence to do so from us or our licensors.

3 thoughts on “FCA failed to pick up on false register entry for 22 months, jury told [Day 5]”