LCF raised £237m by selling some 16,000 ‘bonds’ to over 11,000 members of the public. Marketing material talked of “extensive due diligence” and that “the loans were fully secured”.

The reality was very different – security was in fact said to be “valueless or worth a small fraction of the intended value” having been invested in businesses which “were not carrying out revenue generating activities“. Large commissions were taken by those connected with the company.

Please donate to the Cheese Fund to support crowd-funded journalism.

Reporting by Daniel Cloake.

An independent investigation into the FCA’s supervision of London Capital & Finance concluded in 2020.

The claimants say that at a time of very low interest rates, LCF’s bonds had been sold to numerous unsuspecting members of the public, including some of the most vulnerable people in society. “Many of them entrusted almost everything they owned to LCF.They needed the interest income in order to pay their bills and to survive“.

Reassured by the practised patter of professional sales people, it’s said they entrusted their monies to LCF.

When the reality became apparent, “LCF’s bondholders were distressed“. Retired people who had invested their life’s savings had to confront the reality that they had lost everything. Disabled people, and incapacitated people, who had no prospect of earning ever again, were saddened and angered by the fact that they had been deceived.

Written submissions by Stephen Robins KC describe LCF as being “…a Ponzi scheme from the outset. LCF advanced monies to its borrowers, which those borrowers then repaid to LCF in order to enable LCF to repay principal and pay interest to bondholders“.

In this claim brought by the company and its joint administrators it is said that several people, including Michael Andrew Thomas, 50, the former CEO of the company “was knowingly party to the fraudulent carrying on of business of LCF” meaning they are “liable as a knowing recipient in respect of all monies paid from LCF in breach of fiduciary duty and their traceable proceeds which were received by him“.

A document detailing the full extent of the claims, and the parties to the litigation can be read here.

Prologue

In written submissions to the court by the claimants, reproduced below with minor edits, we’re told about a man called Alan and his daughter Chloe.

Alan lived in Teddington. Chloe was involved in a road traffic accident. She was in hospital, in a coma. The Court of Protection was satisfied that Chloe lacked capacity and appointed Alan to deal with her affairs.

The other driver’s insurer agreed to pay compensation of £3 million. Alan wanted to use the money to generate a return of £80,000 to £100,000 annually whilst also buying a property for Chloe to live in when she came out of hospital.

On 21.01.16, Alan called up London Capital & Finance plc and spoke to a salesman called Scott Allen who suggested that he should put £1.25 million of the compensation money into a three-year bond, which would yield 8% per annum.

Scott Allen explained in a subsequent e-mail that LCF was a financial institution which raised funds in order to make loans to UK businesses. Scott said that LCF had a proven track record and had recently issued a series of bonds to help with the growing demand for commercial finance. Scott said that the LCF bonds offered a chance for investors to take advantage of this growing market in a secure way.

Scott also told Alan that LCF had an experienced team who assessed all loan applications and that all loans were made on a secured basis at no more than 75% loan to value.

Scott forwarded this email to John Russell-Murphy who was a senior sales person at Surge Financial Limited. Scott explained Alan’s situation and suggested that Alan could benefit from a home visit by John Russell-Murphy .

John Russell-Murphy ’s visit to Alan was arranged for 05.02.16, a Friday.

In the meantime, Alan sent a copy of the Court of Protection’s order to John Russell-Murphy who told Paul Careless about it.

Paul Careless welcomed this news.

He was excited by the thought of the 25% commission that would be payable to Surge Financial Limited (“Oh by the way if JRM pulls off that 1m Friday then I’ll be buying a 70k car from the comms the week after … Operation Fuck You Everyone Who Didn’t Believe”).

Alan agreed to invest £1.25m into a three-year bond.

LCF’s payment processor received the £1.25 million from Pennington Manches LLP on 18.02.16 and transferred it (net of fee’s) to LCF.

Prior to the receipt of these monies, LCF’s credit balance had stood at £134,021. Afterwards, it was £1,377,771.12.

Within the next 24 hours, LCF paid £944,000 to Leisure & Tourism Developments, which paid £575,000 to Spencer Golding, £90,000 to Helen Hume-Kendall and £30,000 to Michael Andrew Thomson.

LCF also paid £370,000 to Surge Financial Limited. This included 25% commission on the Alan/Chloe “deal” in the sum of £312,500.17

Afterwards, LCF’s credit balance stood at £93,591.18

“Holy cow! Paaaarrrtty!”

Katie Maddock of LCF told Surge Financial Limited’s employee Jo Baldock that she had made a payment of £370,000 to Surge Financial Limited.

Jo Baldock emailed Paul Careless to say, “Holy cow! Paaaarrrtty!”

John Russell-Murphy was in the mood for celebrations: he decided to organise drinks “(major piss up)” at the Hotel du Vin in Brighton on 26.02.16, “paid for by the company”.

Paul Careless was excited to report that Spencer Golding was planning to attend (“Spencer’s coming so I predict a riot”).

Paul Careless decided to use the commission to fund a “one-off bonus”: £100,000 for himself; £100,000 for John Russell-Murphy (via his company, D9); and £2,000 for Scott Allen (who had dealt with Alan’s initial enquiry).

Surge Financial Limited also paid £10,000 to Spencer Golding’s son, Lewis, with the reference “Careless JRM”. Paul Careless reported, “Spencer payment of £10k done”.

Everyone was looking forward to the party (“Many thanks Steve, see you at the bar on Friday”; “Yep, see you there!”).

Soon, the party day arrived. A few of the defendants booked rooms at the venue to stay overnight which were paid for by Surge Financial Limited. The total bill for food, drinks and rooms came to £3,400.

Booze flowed in abundance leading to hangovers the next day (“Hope you had a good day yesterday and did not feel as bad as me this morning!”).

On the following Friday, John Russell-Murphy went to Teddington to give the bond certificate to Alan, who had no reason to suspect that the entirety of his daughter’s money had already been paid away by LCF to the recipients mentioned above.

“In my view,” said Paul Careless, “the only risk in life, is not taking a risk. No one became

successful by waiting”.

The prologue concludes that Chloe is still waiting for her money and that she continues to be the largest individual creditor in LCF’s administration.

The Trial

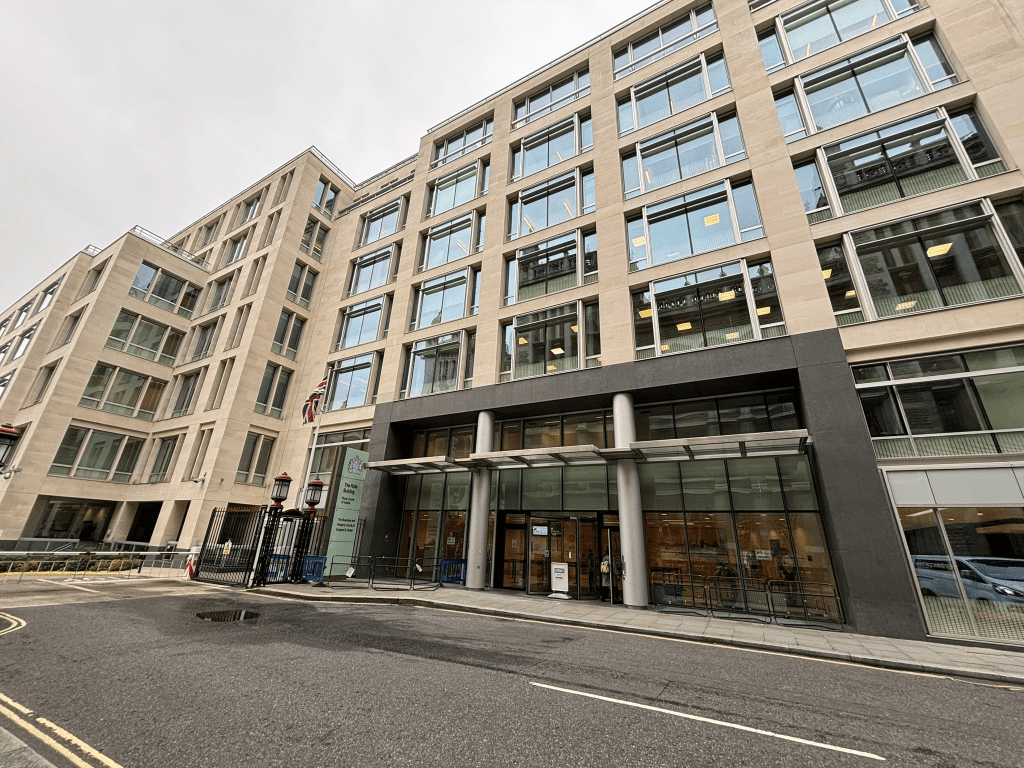

This 20-week-civil-trial started on Monday 19th February 2024 at the home of the Business and Property Courts in London – the Rolls Building.

The trial is open to members of the public who, after going through the airport style security, can proceed to court room 15. You can check the start time of the hearing the evening before by checking the hearing list.

Day 1

I live-tweeted a bit of the first day.

I’d recommend the Law Gazette’s write up for a fuller account of what happened “Civil case over £237m collapse of London Capital & Finance opens – with counsel leaving“

300 Pages of submissions

For those who are really interested the mouseinthecourt is publishing a slightly redacted version of the Claimants written submissions to the court.

The claims have yet to be tested in court and the defendants, unless otherwise indicated, should be taken as denying any accusations of wrongdoing.

The mouseinthecourt will be making efforts to obtain other documents with a view to publishing them. You can support our work by donating to the cheese fund.

Download the claimants written submissions (10mb) here:

The work on this site is protected by copyright laws and treaties around the world. All such rights are reserved.

You may print off one copy, and may download extracts, of any page(s) from our site for your personal use and you may draw the attention of others within your organisation to content posted on our site.

You must not modify the paper or digital copies of any materials you have printed off or downloaded in any way, and you must not use any illustrations, photographs, video or audio sequences or any graphics separately from any accompanying text.

Our status (and that of any identified contributors) as the authors of content on our site must always be acknowledged.

You must not use any part of the content on our site for commercial purposes without obtaining a licence to do so from us or our licensors.