Professional auditing firm Moore Stephens acted “negligently” and with a lack of “professional scepticism” when they signed off the accounts of the now failed peer-to-peer lending firm Lendy, documents filed at the High Court claim.

This site is financed by donations to the ‘Cheese Fund‘ or you can buy me a coffee here

Reporting by Daniel Cloake

In a 25-page-document prepared by top barrister Nicola Rushton KC we’re told that Lendy Ltd, a company which facilitated the crowd funding of investments by members of the public, instructed Moore Stephens to audit their accounts for years ending 2016 and 2017.

It’s said the firm Moore Stephens, now known as MSR Partners LLP since their merger with BDO LLP, was picked by the directors of Lendy “because it was a “top 10” auditor which had experience of auditing entities regulated by the FCA and was on the FCA’s Skilled Persons Panel“. A high standard of work was therefore expected.

One such standard, known as ISA 250 Part B, required auditors to report “an apparent breach of statutory or regulatory requirements” if it “comes to the auditor’s attention” to the Financial Conduct Authority.

In this High Court claim it’s said that no such report was made because Moore Stephens failed to spot that Lendy’s financial documents were “defective“, “highly misleading”, and that they included “material misstatements“.

If such a report had been made then it is claimed there is “a high degree of certainty that the FCA would have taken rapid enforcement action against Lendy to prevent further investment and lending if the Defendant had acted non-negligently“.

This site has reported extensively on the FCA’s relationship with the peer-to-peer lending industry. Our exclusive report “Did internal politics and a culture of confusion at the FCA fail P2P investors?” looked at internal struggles within the city regulator as junior members of staff tried to raise the alarm over a number of years.

We have also reported on a confidential 2017 FCA report which revealed a catalogue of concerns at Lendy and how a loan book review was ordered after “vital” failures were identified. We also exclusively revealed that the FCA were aware in 2016 that one of the co-directors, Tim Gordon, had “borrowed” £350k from the Lendy Client account.

Lendy collapsed in 2019 following action taken by the FCA with Damian Webb, Phillip Sykes and Mark Wilson of RSM appointed as Joint Administrators.

Over 11,000 members of the public had £152m outstanding in loans at the date of administration, with a number of loans, some 5 years later, still yet to be realised.

The claimant in this legal action is Manolete Partners Plc, self-styled as the UK’s leading insolvency litigation financing company. It is understood that the joint administrators of Lendy assigned the claim to Manolete in February 2024.

We asked RSM UK for details of the assignment last week and they didn’t get back to us.

The claim states that the accounts for the years ending 2016 and 2017 “did not give a true and fair view of Lendy’s affairs and/or its profit” and that “they had not been prepared in accordance with applicable UK accounting standards“.

It’s also said that the accounts had “included as business expenses significant sums which were in fact a disguised means of extracting funds from Lendy“.

This was a reference to the so-called Marshall Island payments, themselves the subject of a High Court claim against the two former directors of Lendy. Our extensive coverage of that case can be read here. The claim settled by means of a confidential agreement in October 2022 and as part of that it was subsequently revealed by this site that the directors’ were making a repayment of some £3.4m.

In short it was claimed that the directors had created false invoices to channel money off-shore, which would then be ‘loaned’ back to them on pre-paid credit cards. This meant the company could avoid paying corporation tax, and the individuals could avoid income tax and NI. All accusation of wrong-doing were denied throughout.

It is claimed that no reference was made to these Marshall Island payments, which totalled some £6.8m, under “related parties disclosures” in either sets of the accounts signed off by Moore Stephens.

We’re told that Moore Stephens had queried these payments with Lendy and had received a response which “plainly suggested that these [off-shore] entities were in fact connected with Lendy and/or its directors, that transactions with them were not at arm’s length and that it was questionable whether any genuine services had been provided at all“.

“radically inconsistent explanations”

The response from Lendy was said to contain “radically inconsistent explanations of the services supposedly provided by these companies for these payments (sometimes described as fees for introduction of borrowers, sometimes as fees for introduction of investors; elsewhere said to be for provision of web-based services);“

Apparently “supposed invoices from [the off-shore companies] were each numbered consecutively, indicating they had no clients other than Lendy;“

The claim says in no uncertain terms that “there was no or no proper explanation of the oddities and inconsistencies in the documentation and responses, and no explanation of why services were being provided by companies located in the Marshall Islands.

“professional scepticism”

“Further the assertions from Lendy’s directors that these entities were not related parties and the relationships were purely commercial were unconvincing and, had appropriate professional scepticism been applied, should have raised questions as to the integrity of the directors.”

It’s said Moore Stephens failed to apply “heightened professional scepticism” and failed to obtain “truly independent corroborative evidence” instead relying on “uncorroborated assertions from the directors“

It’s claimed that “If more searching enquiries had then been raised, either it would have been established that these were not genuine business transactions, or Mr Brooke would have provided unconvincing justifications for them that in turn would have led to further inquiries and heightened questions as to his integrity.“

Another example of deficiencies within the audited accounts is said to be that Moore Stephens failed to take into account that the “submission of the … 2016 financial statements was already significantly late” when it came to be signed-off.

It is claimed Moore Stephens had made “no allowance … for interest and/or penalties on the consequent delayed corporation tax payment, which was a misstatement and probably a material one“.

They had also apparently not considered “properly or at all whether this was a deliberate attempt to avoid payment (and so whether they should continue to act as auditors) or whether this was due to cashflow issues (and so whether this affected the Defendant’s going concern assessment)“.

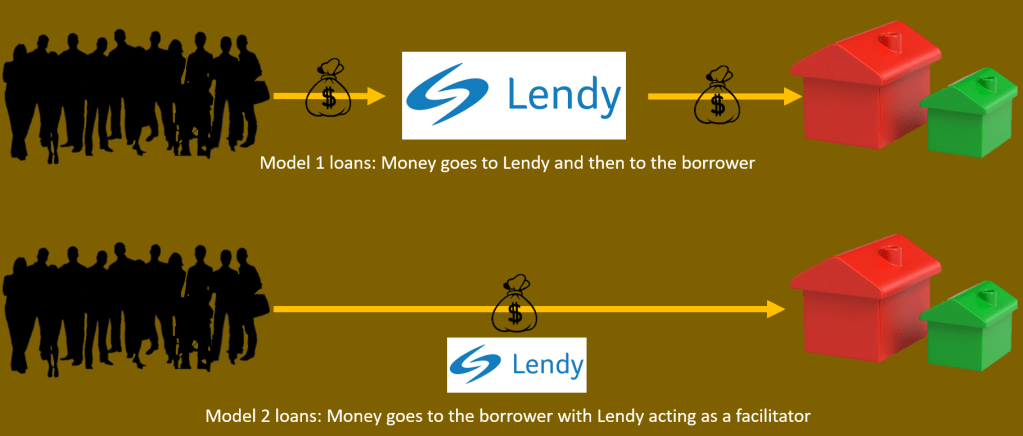

Model 1 v Model 2

Lendy operated two ‘styles’ of loans. A technical explanation can be read in paragraphs 5 – 15 of this high court judgment.

The claim states that “The accounting policies in the financial statements in FY2016 and FY2017 entirely omitted the key judgement over whether Lendy was acting as principal or an agent in the operation of its business, specifically in relation to its “Model 1” and “Model 2” loans.“

“fundamentally inconsistent and confused”

It’s said “the true position was therefore fundamentally inconsistent and confused, in that Lendy was required by the FCA to act solely as an agent, but its actual conduct of its business was in some ways more characteristic of a principal“.

The claim asserts that “this should have been expressly resolved and reflected by the accounting policies” and “since they failed to do so, the financial statements were highly misleading and could not be approved by the Defendant consistently with its obligations…“.

Remedy

The claim states that had Moore Stephens “not acted negligently and in breach of contract …then Lendy would have been unable to file financial statements for FY2016 or FY2017…” and subsequently the FCA “would rapidly have taken enforcement action against Lendy, forcing it to stop accepting any further funds from investors or facilitating any new loans within a very short period of time“.

It’s stated that from 1st March 2018 until Lendy’s entry into administration on 24th May 2019 the additional amounts invested by investors totalled £27,552,398 of which the loss is estimated at £15,599,571.

The claim also asserts that “there is a reasonable chance that additional sums could have been recovered from borrowers if administrators had been appointed sooner.” But “further particulars will be provided upon disclosure of the Defendant’s audit files” which, despite requests, have not been released.

The claim also says the defendants are liable for repayment of the total value of dividends of £1,937,930 “which were unlawfully paid“.

The claim also alleges liability for “increased costs of the administrators; and interest and penalties charged by HMRC due to delayed payment of the corporation tax liabilities“.

The defendants have yet to file a defence but should be assumed to deny any allegation of wrong-doing. The claims have yet to be tested in court.

Case details

Manolete Partners Plc v MSR Partners LLP

Case Number: BL-2024-000191

MSR Partners LLP are represented by Clyde & Co

Manolete Partners Plc are represented by Gateley