The Crown Court has ordered the director of a failed peer-to-peer lending company to pay compensation to over 1,000 investors who were victims of his fraudulent activity.

Collateral (UK) Limited was a finance company which facilitated investments crowdfunded by members of the public. The firm and two related companies entered administration in April 2018.

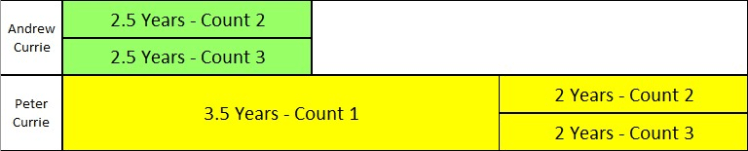

The two defendants, Andrew Currie, 60, and Peter Currie, 61, both denied two charges under the Fraud Act 2006 and one charge under the Proceeds of Crime Act 2002 in a criminal prosecution brought by the Financial Conduct Authority.

They were convicted after a jury trial in July 2023 and received sentences totalling 8 years.

For further information about the case, and to see our reporting of every day of the trial, please visit our main information page.

Please donate to the Cheese Fund or buy me a coffee to support crowd-funded journalism of the P2P sector.

Reporting by freelance journalist Daniel Cloake.

Following the conviction of the two brothers it was announced by the FCA that they had “begun confiscation proceedings to recover the financial benefit obtained by the defendants, as well as compensation proceedings to recover investor funds“.

This site previously covered a hearing which set the timetable for this proceeds of crime hearing.

In November 2024 this site covered the proceeds of crime hearing in relation to Peter Currie. Over 1,000 victims were set to receive just 500 pence each. The court found at a previous hearing that the criminal benefit he had received was some £204,669.27.

Monday

The hearing began with Stuart Biggs KC, the barrister representing the FCA, telling the court that the matter was contested. Unlike with Peter Currie, where the parties were able to agree an amount between them, this meant the court would hear evidence and the judge would decide both the ‘benefit’ from the crime and the ‘available amount’ to calculate a final ‘recoverable amount’.

Proceeds of Crime applications have a reversed burden of proof – this means it is Andrew who must show, on the balance of probabilities, that any funds identified are legitimate, rather than the FCA having to prove that they are from criminal proceeds.

Andrew was convicted on two counts which related to:

(i) The fraudulent transfer of £275,000 from Collateral UK Limited to Auri Developments Limited, a company established by the director Sarah Gayton, Andrew’s then partner. (Count 2)

(ii) The taking from Collateral UK Limited of £372,299.52 (marked as broker fees) after a point in time at which he knew or suspected that the money within the company represented the proceeds of crime (Count 3).

Written submissions made to the court by the FCA reveal that a total of some £805,820, increased to £1,061,103 to take into account the consumer price index rate, should be taken as the so-called benefit amount – the amount that Andrew is said to have benefited from his criminal conduct.

Straight into the witness box was Mr Ramesh Patel who explained he was an FCA lead investigator and had been since around the time of the conviction.

Mr Patel said he had carried out an investigation into the financial circumstances of Andrew Currie, including tracking down bank accounts, and following where the money had gone.

At the trial the court was told that some £275k had been sent from Collateral UK Limited to Auri Developments Limited. Mr Patel confirmed that the FCA’s position was that Auri Developments was effectively “ultimately controlled” by Andrew Currie, despite Sarah Gayton, described as his “romantic partner“, being listed as the sole director.

It was said the £275k was therefore “either a tainted gift, or money which can be traced through and has always been his“.

Mr Patel confirmed that he had also “traced a sum of approximately £64k into a Nationwide bank account in the name of Sarah Gayton” and that a restraining order had effectively frozen that account.

The court was told that Ms Gayton had declined to provide a witness statement, or evidence to the court, despite having been given notice of this hearing. She was not in attendance at court.

Mr Patel also ran through transactions in several bank accounts, only some of which had been declared by Andrew. These accounts were said to contain transactions showing a link between a company called AC Grass Limited, with its sole director Chay Currie, 29, and Andrew himself. Chay is Andrew’s son.

A personal bank account in the name of Andrew was said to show large payments to a fake grass supplier. [i.e. a real supplier of fake grass]. Two AC Grass company bank accounts also had Andrew as the sole signatory, and had a postal address of Andrew’s, not Chay.

Biggs asked if the “conclusion was that AC Grass Limited is [Andrew’s] business?” “Yes” replied Mr Patel.

Mr Patel confirmed he had traced payments from accounts operated by Andrew to companies under the directorship of Sarah Gayton. This included one called Oscar and Oakley Limited.

In response to this we were told Andrew had produced a stack of invoices purporting to show they were legitimate payments. However, Mr Patel said the payments were going the wrong way to the invoices, and so he held his view these were “tainted payments“.

The court was told that payments had also been made to ADCKK Ltd, ADCKK2 Ltd, and Dinky’s Hampers Limited, all companies where Sarah Gayton had been a director. The ADC in the company names was said to stand for Andrew Douglas Currie.

Mr Biggs KC said in his closing submissions that Andrew’s “evidence as to the extent of his control of retail businesses run through companies for which Sarah Gayton was a director (Dinkys Hampers, Oscar & Oakley Ltd, ADCKK2 Ltd), was not credible and was contradicted by other evidence“.

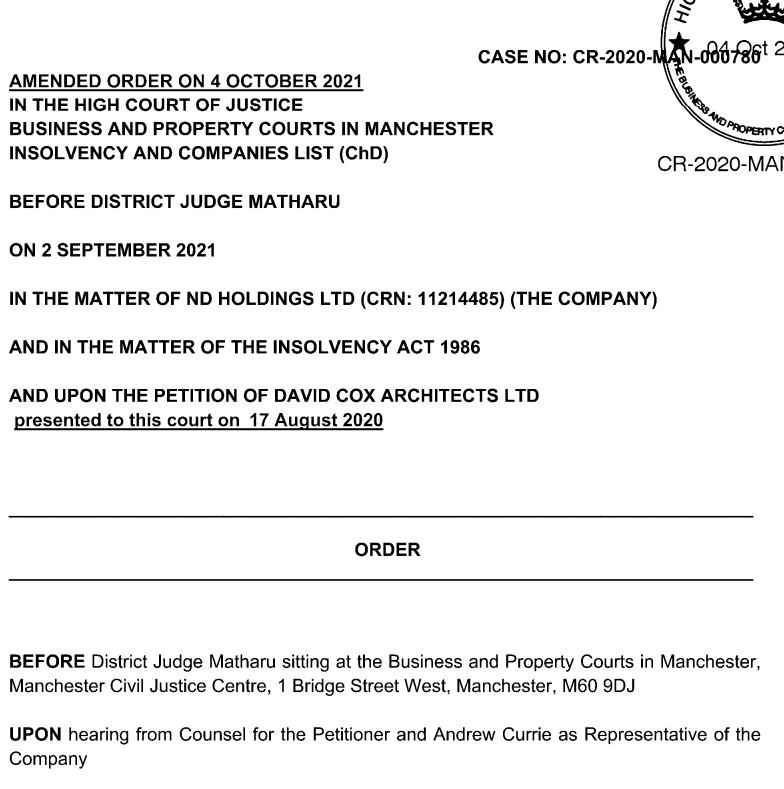

Another example was given in court, that of ND Holdings Limited. The company, with Sarah Gayton as director, had been placed into liquidation in September 2021.

The court order from the insolvency hearing was exhibited by Mr Patel.

The last paragraph of the order, shown here, makes clear that it was Andrew Currie who appeared to represent the company.

After a lengthy review of some of Mr Patel’s analysis Mr Biggs asked: “Are you satisfied that you have been able to find all of Mr Currie’s assets?” “No” replied Patel.

Q: “Is your position, the FCA’s position, is that he hasn’t been frank about his assets?“

A: “That’s right.“

In cross-examination Henry Grunwald OBE KC, the barrister representing Andrew Currie, confirmed with Mr Patel that the date of Andrew’s statement, said to have omitted certain bank accounts, was 8th April 2024 and that Andrew had only been released from Wandsworth Prison on 22nd March 2024.

“Would you also accept for someone in prison it’s difficult to access bank accounts and transactions?” asked Grunwald. Mr Patel agreed.

It was also accepted that some of the bank accounts had only been open for a short amount of time and some had closed about two years prior to the statement having been written.

Mr Patel also answered in the affirmative when asked if he was “aware [the administrators] had in one way or another lost, misplaced, deleted a lot of emails during the period dating back to the period Collateral was trading?“

The relationship between Andrew and Sarah Gayton, said to have ended in 2022, was touched upon as Mr Patel had emailed her asking for information in preparation for the hearing. Her response, that being associated with Collateral UK had caused “trauma” and “irreparable damage to my life”, also contained an assertion that she “absolutely” did not hold any assets on his behalf.

Mr Patel’s belief that there could be further assets or bank accounts, which had not been disclosed, was also challenged. It was put to him that as it “may be part of your professional role to be extra suspicious, you may have been looking for extra bank accounts“. Patel agreed. “You’ve not found any?” “No.“

Grunwald referred to the “hundreds and hundreds, almost a thousand pages” of bank statements produced and asked Mr Patel whether these showed further undisclosed accounts.

Patel replied it’s “one of those questions that you don’t know until you know“.

Tuesday

Andrew Currie entered the witness box and was asked questions by his lawyer Henry Grunwald OBE KC.

Andrew told the court that he was currently working as a chef, through an online booking platform, resuming a role he last carried out 40 years or so ago. Curfew restrictions imposed after his release from prison initially meant he could only work between 7am – 7pm.

We were told that his gross income was circa £70k-£80k although costs of the food, travel expenses, and so on would be paid out of this amount.

Earlier in 2025 Andrew said he had also made some money by either brokering some landscape sales, or by selling jewellery. He said that any items sold were drop shipped.

Andrew was asked about the statement detailing his assets made shortly after he had been released from prison. “In that statement were you deliberately trying to conceal anything?” “No” Andrew replied.

It was claimed that important information was lost when Andrew’s iPhone and iPad were “lost or misplaced” at Wandsworth prison. No back-ups were said to exist. Mr Biggs KC would later submit that this explanation “lacked credibility“.

Q: “In relation to your own bank accounts which you were asked about. Did you have access to all the material you would need?“

A: “The bank would not let me have access. They say ‘we are closing your account’ and that they can give no further information about why they have taken their decision“

Asked why his bank accounts were being closed Andrew explained this was part of a “pattern” where he would open an account and after “a period of time, I’d get a letter saying the account has been restricted”. He speculated this was because of the nature of these proceedings as fellow convicts, namely a drug dealer and a strangler, had no difficulty opening accounts.

The AC Grass business was also discussed. Andrew explained that AC Grass was a joint venture between his son and himself, with whoever sold the drop shipped artificial grass keeping the commission. The business had “no premises, no stock, no assets, it was just drop shipping“.

Citing the actions of financial institutions he said it was “embarrassing” and “very uncomfortable to ask customers to use these new bank details” every time an account was closed.

Andrew said that he and his son parted ways and it was Chay who set up AC Grass Limited which was a completely separate venture – “He didn’t want to be tainted with this” claimed Andrew.

In cross-examination by Mr Biggs KC the defendant was questioned about the other so-called Sarah Gayton companies.

One of them, MMAP, had a number of directors in addition to Ms Gayton. The purpose of the company was to facilitate investments. Asked “what was [Sarah’s] background in setting up bonds and floating PLCs?” Andrew replied she didn’t have one.

“The only reason she was on the board was that she was your partner” said Biggs. Andrew replied that wasn’t the only reason.

Andrew said his role with the firm was to “drive business to the company“. A bank statement was examined, prompting the judge to remark on the small font and then take out a magnifying glass, showing a number of payments from MMAP to Andrew.

In closing submissions the FCA said MMAP had received tainted gifts totalling some £58,165. Along with some £14,161, and £2,269 said to have been sent to Sarah Gayton, for a Range Rover Evoque and a sofa respectively.

Chay Currie was said to have received a “tainted” £34,317.

Andrew’s written submissions

Mr Grunwald KC said that Andrew “will assert that, as a matter of fact, he did not and does not have a criminal lifestyle” and warned the court not to make assumptions about some of the sums of money as this could create “a serious risk of injustice“.

Put bluntly we were told “it is not accepted that the Defendant has concealed assets. Neither is it accepted that the Defendant has sought to dissipate his property by way of tainted gifts.“

It was submitted that “the Court is urged to be slow to disbelieve oral evidence provided by the Defendant simply by dint of an absence of corresponding financial records” as “obtaining relevant and exculpatory paperwork has been a much more challenging task than would otherwise have been the case.“

We are told Andrew is “an individual struggling to make his ends meet” whose situation is “not consistent with an individual in possession of significant hidden assets.“

The Ruling

The mouseinthecourt is very grateful to HHJ Griffith who offered, in the course of an oral application for copies of the parties written submissions, to send him a copy of the courts judgment.

We are publishing the text of the ruling as follows:

This is a POCA application occasioned by the conviction of the Defendant Andrew Currie on Counts 2 and 3 of the indictment. The offences were fraudulent transfer of £275,000 from Collateral UK to Auri Developments Ltd and money laundering in respect of £372,299.52 taken from Collateral as broker fees.

I have had the benefit of many schedules compiled by Mr Patel the FCA expert together with skeletons from both the Prosecution and the Defence, culminating, after the evidence was finished in skeletons dated 14th November from the Mr Biggs KC for the Crown and 28th November from Mr Grunwald KC for the Defence.

Benefit

The Crown allege that, at a time when the FCA were in the process of making announcements in relation to Collateral, which were likely to have a seriously deleterious effect on Collateral, the Defendant was involved in stripping assets from Collateral. They allege that both sums amounted to benefit.

In Count 2 he caused the payment of £275,000 to Auri Developments and in Count 3£372,299.52 from Collateral as “broker fees”. There is some dispute as to whether the £275,000 were the Defendant’s benefit but I conclude that the sum was paid to Auri Developments Ltd a company under the control of his then partner, Sarah Gayton. In effect, as it was transferred with no formal legal document to explain the transfer, I conclude that it remained under his control and had been paid as she and her company represented a safe depository. I consider that it was his benefit. The initial sums therefore amount to £647,229.52.

In addition Mr Patel identified further payments to the Defendant of £32,521.27. I conclude that they are also his benefit.

Finally the Crown allege that, pursuant to the Act unexplained cash deposits in his bank accounts are further benefits. The Defendant explained these deposits generically. The burden rests on him to prove that they are not the proceeds of general criminal conduct. Considering what he said were the reasons I have some doubts about their provenance but doing the best I can I will take it that some were not proceeds and reduce the figure from £126,000 to ¼ of that – £31,500.

Accordingly the benefit figure is £711,250.79 plus the CPIH [a form of Consumer Price Index] uplift.

Realisables

As both sides agree, once I decide the benefit figure I have to order him to pay it unless he shows to me on the civil standard that he has insufficient funds to do so. The Defence case is a simple one, save for a the small balance in a bank account he has no funds to discharge the around many thousands of pounds of benefit.

He has given me evidence to that effect. He gave evidence to the jury about the sums covered by Counts 2 and 3. On both occasions I have found him to be an unreliable witness and one whose evidence I disbelieve. The effect of such a finding is obviously not that I must order him to pay the whole sum of benefit. I must always consider proportionality and whether it would be a proper decision to order him to make payments in such large sums. I have already dealt with his evidence about the sums advanced to Auri where I disbelieved his account.

Working through the Crown’s headings:-

The first sum is the balance in his accounts said to be £2,516.07 is agreed to be realisable.

Secondly, the sum of £275,000 advanced to Auri has been reduced to £64,146.43, which is restrained in Sarah Gayton’s bank account in Spain, together with the value of the Fleetwood investment said to be £30,000. In addition the Crown point to the existence of a liquidator in respect of the Fleetwood property which may complicate matters. At present, subject to any further applications I would include £94,146.43 as a realisable sum.

Sarah Gayton was invited to appear in these proceedings, she has not done so but has sent an email claiming that the money in her account in Spain in hers. She has not given me any evidence and my view is that the sum represents the Defendant’s benefit and is realisable as such. I find that that sum (£64,146.43) is available to him.

Further, Mr Patel has identified payments made to or for Miss Gayton and to his son Chay, as tainted gifts. These are listed compendiously in Mr Biggs’ submissions paragraph 34.

The Defendant explained those as being sums he owed Miss Gayton as a result of their relationship which ended at the end of 2022. Mr Patel identified 2 substantial vehicles for the payments, payments direct to her and payments on her behalf in respect of a Range Rover Evoque. These total almost £100,000. He told me that they were payments as a result of them being together and that subsequent to this serving his sentence he now owes her £19,000 in respect of money that she expended in keeping a property available to him on release.

I disbelieved his evidence that all of these sums were in respect of shared expenses, Mr Patel had reduced the sums on his best calculation of sums genuinely expended as a result of the partnership. I consider that the amount of money that he expended on her in 5 years must be treated as tainted gifts. I will reduce that sum by half but it remains £50,000.

In addition he paid £34,317 to his son. He told me that the sums that he was paying were made up of family assistance and payments for the businesses that his son was running. His evidence is in contradiction to Mr Patel who concluded that these were the Defendant’s businesses. That was another area where I disbelieved his evidence. The Crown have accepted that the payments that he made to his daughter, a single mother, over the same period were made from their familial relationship. They total £3,945.

Again, doing the best that I can I find that much of these payments were tainted gifts. Again I reduce the sum by 50% which means that £17,000 is available to him.

Finally Mr Patel identified payments made by the Defendant to various companies, Dinkys, O&O, ADCKK2 and MMAP. These total £90,000. Mr Biggs characterises them as possible benchmarks for hidden assets. I agree with that characterisation in respect of the lion’s share of those sums, £58,165 and £26,569 which were payable to MMAP or to entities through Transferwise for MMAP.

The Defendant agrees that he was involved with MMAP as an investment company and that he paid those sums into MMAP. He said that he was paying in money from others in respect of the company, which was trading on the Vienna stock exchange for high worth investors. He agreed that he had no documents to support what he said about those payments. Again I disbelieved his evidence about these sums and I conclude that these are certainly capable of being hidden assets.

In the absence of any explanation of what they were for and what is the present position of MMAP I consider that this sum should be seen by me as available if I conclude that he does not have the £700 odd thousand to meet the benefit figure.

The Defendant’s position is that he has no money to meet the benefit figure. He says that he lives modestly, has cashed in his pension to meet expenses. This set of affairs is prayed in aid by Mr Grunwald but Mr Biggs’ references to R v Michael Summers [2008] EWCA Crim 872 (his para 32) show how that can be expected in hidden asset cases.

I therefore conclude that the benefit figure for the Defendant is £711,250.79 plus uplift.

On extensive investigation by Mr Patel the Defendant’s available assets are insufficient to satisfy such an order.

I find that the realisable amounts are:-

1) £2516.07

2) £64,146.43

3) £30,000 for the value of the Fleetwood property

4) £50,000 in respect of tainted of tainted gifts to Sarah Drayton

5) £17,000 in respect of tainted gifts to Chay

6) £84,000 in respect of hidden assets in respect of MMAP

By my calculation they total £247,662.50 plus uplift, where appropriate. There will be a confiscation order in that sum and a default sentence of 3 years imprisonment if the sums are not paid in 3 months.

Compensation order in favour pro rata of those investors in Collateral who have made a claim.

There will be a Victim Surcharge drawn up.

HHJ Griffith

9th January 2026

FCA Press Release

In a press release, dated 9th January 2026, Steve Smart, executive director of enforcement and market oversight at the FCA, said:

“Mr Currie sought to profit by defrauding unwitting investors. Today’s decision is a clear warning to fraudsters and scam artists that we will pursue them and ensure they don’t benefit from their criminal activity.“

Case details:

Courtroom 16 Southwark Crown Court

Before His Honour Judge Griffith

3rd November 2025 11.30

4th November 2025 11.00

12th December 2025 10.30

9th January 2026 14.00

Case number: T20220056

CURRIE Andrew

The Financial Conduct Authority are represented by barrister Stuart Biggs KC.

Andrew Currie is represented by barrister Henry Grunwald OBE KC, assisted by Ms Kathleen Mulhern

The work on this site is protected by copyright laws and treaties around the world. All such rights are reserved.

You may print off one copy, and may download extracts, of any page(s) from our site for your personal use and you may draw the attention of others within your organisation to content posted on our site.

You must not modify the paper or digital copies of any materials you have printed off or downloaded in any way, and you must not use any illustrations, photographs, video or audio sequences or any graphics separately from any accompanying text.

Our status (and that of any identified contributors) as the authors of content on our site must always be acknowledged.

You must not use any part of the content on our site for commercial purposes without obtaining a licence to do so from us or our licensors.