The County Court has granted the failed Peer-to-Peer lender FundingSecure possession of an East London flat, and a money judgment of some £200k, after rejecting a borrowers claim that their mortgage broker had been bribed with a so-called secret commission.

Please donate to the Cheese Fund to support crowd-funded journalism of the P2P sector.

Reporting by Daniel Cloake.

In July 2016 an amount totalling some £68k, crowdfunded by members of the public using the FundingSecure platform, was advanced to two borrowers, Ms Fahmida Anwar of London E1 and Ms Ruxana Begum, of London E2. This was secured by a second charge against a buy-to-let flat in Redclyf House, Bethnal Green.

The loan had been ‘rolled over’ to account for accruing interest and the total amount borrowed ultimately increased to £78,000. No repayments were made.

The court was told that the total amount due, as of day one of the trial, was around £203,000 including interest. Legal costs of some £130k had also accumulated.

The court was told that the purpose of the loan was to allow a Mr Islam, the husband of Ms Begum, to finance a business exporting cars to Bangladesh.

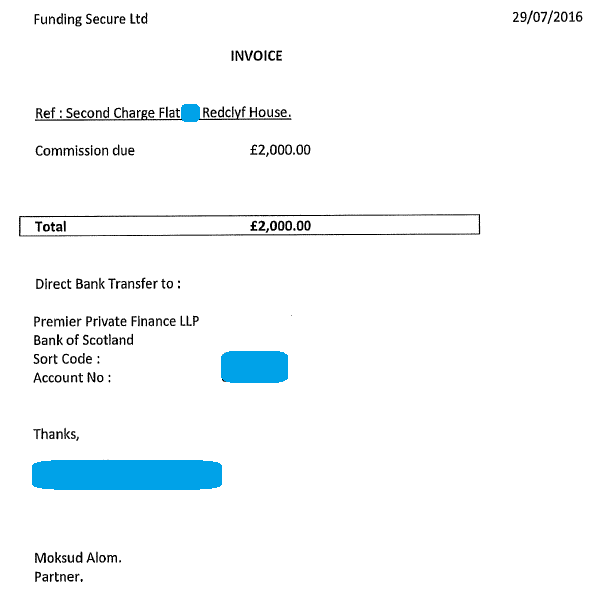

A Birmingham based mortgage broker called Premier Private Finance LLP had been instructed by the borrowers. The ‘LLP Designated Member’ of Premier is Mr Moksud Alom, 48. An attempt to join the firm as a party to the litigation was denied at a hearing a few weeks ago.

In written submissions Mr Alom said his role was “to advise [the defendants] and to recommend to them the best product they could get“. He says that after searching the market it was FundingSecure that could offer the best product.

We were told that Mr Alom had met the directors of FundingSecure at a roadshow in Birmingham in the summer of 2015. “Since then, they have arranged over 250 loans for my clients which is borrowing in excess of some £60M“.

Criticism of FundingSecure

In written submissions to the court Mr Alom was critical of the “relaxed approach to lending” said to exist at FundingSecure.

“from my experience with other lenders … FundingSecure had a very relaxed approach to lending. In my experience with them I do not believe they do credit checks or Registry Trust searches (for County Court judgments) as lenders do as part of their due diligence.

“All FundingSecure do is look at the valuation, see what is outstanding and then make a decision to lend up to 70 or 75% of the value.

“A number of lenders with whom I work conduct phone interviews with borrowers to discuss the terms of lending and to satisfy themselves that the borrower is aware of what they are doing. In my experience FundingSecure do not do this. In fact the first communication is often after the loan has already been drawn down.

“At the time of this loan, FundingSecure were growing rapidly, in order to speed up the process, they were even prepared to waive the requirement for permission from the first charge holder and proceed on the less secure option of registering an equitable charge”

It is important to consider the above comments in the context of the ultimate findings of the Judge as to Mr Alom’s motivation in these proceedings.

Some of these statements were however corroborated by former FundingSecure director Nigel Hackett who told the court he was “still technically a director of FundingSecure” but is now “working as a consultant for the administrators“. FundingSecure collapsed in 2019.

Nigel Hackett outside the Royal Courts of Justice

In oral evidence to the court Mr Hackett explained that it was correct that FundingSecure “would not have any direct communications with the borrowers“, and in this case Mr Alom “was acting as a full broker” in the transaction. “I would have therefore relied on the information provided to me by Mr Alom” it was said in written submissions.

Asked whether he understood the difference between a legal charge and an equitable charge Mr Hackett told the court from the witness box that he “didn’t understand the difference between the two terms“.

Secret Commission

As a result of arranging the loan Mr Alom was paid some £2,000 by FundingSecure.

This was described as a so-called ‘secret commission’ as the defendants say they had not been aware of its existence at the time of entering into the loan agreement.

“Secret commissions” encompasses two different situations. There is “fully secret commission” where neither the existence of or amount of commission is disclosed to a customer.

There is also “half secret” commission where the existence of commission is disclosed, but the amount of the commission is not.

It is understood a fully secret commission is a form of bribe, and allows the transaction in question to be set aside as of right. The defendants would be required to pay back the capital advanced, and a much lower amount of interest – the punishment to the lender is the loss of profit.

A half secret commission, on the other hand, is not a bribe, because the existence of the commission has been disclosed. However, it may amount to a breach of fiduciary duty. We were told the consequence of this would mean the loan agreement remained intact but the £2,000 commission would be deducted.

The court was told that it was Mr Alom who had raised the secret commission issue with the defendants in the first place. Given that Mr Alom was said to have continued to act for the borrowers in arranging new lending the Judge said the “suggestion is that he is in cahoots with his two clients“.

Mr George Mallet, the barrister representing the borrowers, disagreed and submitted that there had been “no real cross examination on motive” of Mr Alom.

Deception to get the loan

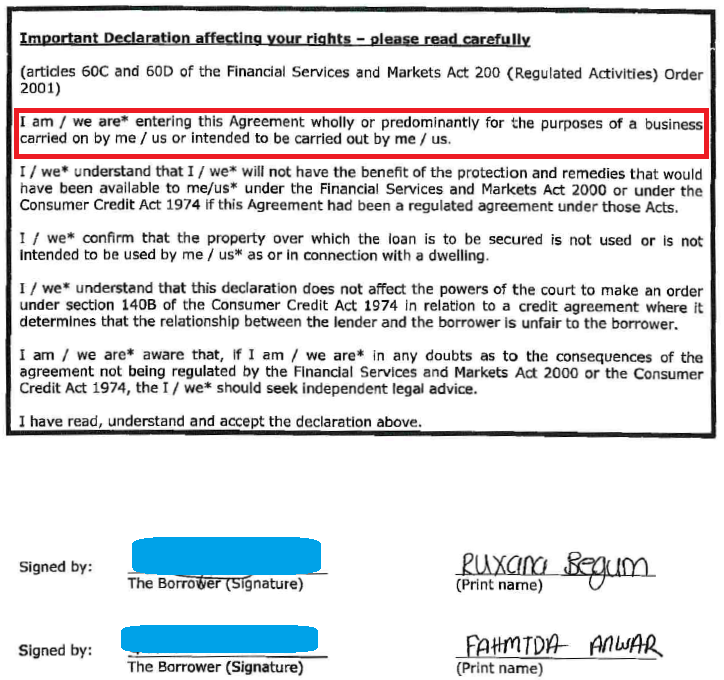

It was agreed that both defendants had signed the ‘Important Declaration’ below in order to obtain the loan from FundingSecure.

Ms Begum was cross-examined in court by Mr Simon Popplewell, the barrister representing FundingSecure. He asked Ms Begum why she had signed to say it was for her business purpose and not her husbands. She replied saying the monies would “benefit me and my family“.

You were “willing to say something that wasn’t true to get a loan?” “I don’t know what you mean” she replied. Later she explained that “at the time I was heavily pregnant and there was a lot going on“.

Mr Popplewell said “I’m suggesting if you were willing to say something untrue to get the loan you would be willing to say something untrue to avoid paying it back“. “No” she replied.

In written submissions Mr Popplewell had contended that both defendants “would be willing to say something untrue to set aside the mortgage.” Could the secret commission defence have been invented?

Ms Begum told the court that whilst the conversations about arranging the loan had been between Mr Alom and her husband, she had been listening to them on speakerphone.

The following exchange occurred in court between Ms Begum and Mr Popplewell:

“You know that Mr Alom is a businessman…obviously he wasn’t working for free?“

“I didn’t pay him“

“You realised someone was going to pay him?“

“I don’t know“

“If Mr Alom is not working for free and is not being paid by your side of the deal he must be paid by the other side?”

“I don’t know“

“If he’s making money he has to get it from somewhere?“

“I don’t know“

“He must be getting it from the lender“

“I don’t know“

“Can you name anybody else?“

“I don’t know“

“I suggest you must have know he was receiving a commission from my client as it was the only person who could have paid him“

“I don’t know“

“Is it possible Mr Alom disclosed the existence and amount of the commission and you didn’t hear it?“

“I don’t know“

Any evidence?

An important part in this case would be contemporaneous documents. Mr Alom was asked why he had not disclosed any correspondence between himself and the borrowers.

It was put to him by Mr Popplewell that “there must have been written records“. Mr Alom replied that he “may well have deleted it. If I thought this is no longer relevant, I would have got rid of it“.

Mr Alom explained that he had an ‘e-mail server’ which had a limited capacity and so he would go through and delete e-mails to free up space.

Mr Alom sought to draw a distinction between offering regulated products and carrying out regulated activities which he said had differing requirements to keep records.

The Judge summarised Mr Alom’s evidence to him at one point as “I spoke to Nigel [Hackett] and he told me this was not a regulated loan therefore I did not need to comply with all those bits of paper to avoid confusing the client.” Mr Alom replied “Correct“.

Mr Popplewell referred to the following passage in Mr Alom’s witness statement and said “I suggest to you it is impossible to remember that level of detail without written records“:

Mr Alom said he had only arranged the loan “about 2 or 3 months earlier” which is how he had recalled the details. The witness statement was of course dated 16/9/2022, almost seven years after the conversation with Richard Luxmore, FundingSecure’s other director, had purported to take place.

It was put to Mr Alom that he was “trying to help the defendants in this case” and that “disclosure would reveal the amount of commission“. “No” replied Mr Alom.

“You are trying to hide documents which are unhelpful to the defendants?”

“I have disclosed everything I’ve got“

Asked whether he had a written agreement with the defendants Mr Alom said “I didn’t have a contract – me, I just trust my clients“. A surprising admission from a broker of 22 years experience.

In closing submissions Mr Popplewell told the court that “Mr Alom was not a witness who was trying to assist the court” and there was a “remarkable selective deletion of e-mails… so extraordinary as to be unbelievable“.

Mr Popplewell had also put to Ms Begum that there “must have been something in writing between you and Mr Alom“. “He just gave us advice on the mortgage” she replied.

“As part of that process he would have given you a written document“

“I’m not sure“

“If he had given you a written document you would have read it“

“I’m not sure“

“The reason you haven’t brought any documents to court is because they are unhelpful to your case“

“I couldn’t find them“

The Judge also put questions to Ms Begum.

“When you go to the shops you want to know much something is going to cost?“

“Yes“

“When you go to a mortgage broker who you know is running a business would you want to know much he is going to charge?“

“I left it to my husband“

“Did you talk to your husband – how much is Alom going to charge?“

“Yes, I can’t remember the conversation“

Mr Popplewell questioned Ms Anwar.

“You know [Mr Alom] is not a charity?“

“Yeah“

“You know he’ll be trying to get money by arranging the loan?“

“Yeah“

“Can you name anyone else who might pay him?“

She shook her head

“Had you put your mind to it you must have known he was being paid by my client?“

“Don’t know“

“You would want to make sure you don’t have to give [Mr Alom] any money?“

“Yeah“

A submission by Mr Mallet that the slight vagueness of his clients evidence was because “clearly they were out of their comfort zone” and in a “bewildering situation” was cut off by the judge who remarked “or refusing to pay their debts that’s true“.

Judgment

His Honour Judge Gerald, handing down the courts judgment, said “it is common ground that Mr Alom for his firm PPF was paid a £2k commission in respect of the original loan. The defendants say they were wholly unaware of that commission being paid.“

The judge explained there were two issues for the court to determine. Did the defendants know that commission had been paid to the broker, and if so did they know how much.

Judge Gerald explained his “initial observations about the evidence before the court” was that it’s “striking” that there had been no disclosure of “documents material to the transaction” by the defendants.

The Judge said that “Mr Alom, by court order, had disclosed material communications between himself and [FundingSecure] but none between himself and the defendants or Mr Islam.” Concluding his “overall impression was a filleting exercise” had been carried out “by which Mr Alom had not disclosed and deliberately concealed material documents. I did not find his explanation in the slightest bit credible.“

We were told a “key passage in Mr Alom’s witness statement refers to an email exchanged but which had not been disclosed, adding credence to him deliberately filleting communications so as not to disclose emails which would be material“.

Despite being “very heavily pregnant, the fact that [Ms Begum] took the trouble to be present and listening to the speakerphone during communications plainly indicated the second defendant was fully cognisant on what was going on and fully ventilated on matters“.

The judge said the evidence provided by Mr Alom was “to some extent troubling but generally lacked credibility” and that “some of it was inconsistent and almost incoherent…his evidence, to put it in the vernacular, was all over the place“.

“The other aspect of this is that if the defendants were unaware that Alom was taking a commission or to use the legal word, bribe, it was somewhat surprising the defendants would continue to use his services, which it’s common ground they do“.

“Unless he was so incompetent, it seems to me he was trying to help his existing clients and it seems he has an interest in the outcome of this case“.

Having found Mr Alom “was neither reliable or credible” the judge considered his “evidence was tainted by a commitment to clients who have got themselves into difficulties“.

Defendants must have been aware

The Judge said he was “unable to accept the defendants were unaware the commission was being paid by the broker.“

It would have “been important” to the defendants to “be aware not only of the amount of money borrowed, and its terms” but whether they needed to “find any money from their own resources or the loan. Bluntly they would want to make sure no money from their pocket“.

“In this wicked capitalist world, as the ladies accepted, no one does anything for free”.

“In my judgment where people are prepared to sign loan documentation which is untrue in order to get a loan there is no reason to suppose they say may something to the court to avoid paying the loan“

As to whether this fell into the so-called half secret commission territory the judge said as this “was a low level commercial transaction it was not something which required any further disclosure of the fact of the commission“.

Whilst it had been “important for these defendants to know they were not having to pay commission out of their own pocket. They could have asked Mr Alom what he was being paid” but they were “not concerned at all“.

This was “not one of those situations in which the broker was under any obligation to disclose the actual amount of the commission, it follows there was no breach of fiduciary duty“.

Case Details

Case Number: H10CL529

Fundingsecure Limited (in administration) -v- Fahmida Anwar and Ruxana Begum

Before His Honour Judge Gerald

Court 54, County Court at Central London

31/10/2022 – 02/11/2022

Nigel Hackett didn’t know the difference between a first legal charge and a unilateral notice. B**ls**t.

LikeLike

Really interesting to see such a detailed account of a small commercial matter. Such issues are very rarely covered but much more likely to be encountered in real life. Thank you.

LikeLike