Details of the claim made by the Joint Administrators’ of the failed peer-to-peer finance firm Lendy Ltd against Castleplus Ltd, a valuation company based in Mayfair, have been revealed the mouseinthecourt can exclusively report.

The underlying loans on the platform are understood to total £4.5m collectively crowdfunded by some 5,300 members of the public.

Lendy collapsed in May 2019 amid significant financial and regulatory difficulties.

The loans were secured against a riverside marina and boatyard known as Hampton Riviera, Hampton Court Road and an adjacent Chalet. Investors on the Lendy platform will know these as PBL157 & PBL158.

Since the advancing of the money in January 2017, investors in the Riviera loan are understood to have received just 11% of their £1.3m back in March 2023. The Chalet loan repaid just 31% of its £3.2m, also in March.

The Chalet (Source: Lendy Website)

The Chalet was described as “London’s ultimate party pad” by the Evening Standard in 2020.

In January 2022 this site exclusively reported on an injunction application over the Marina instigated by Richmond Council in ‘You’re taking the Myck!‘

The defendant in the claim is Castleplus Limited, the trading name of John D Wood: “a well-established Commercial Property Consultant with a superb name and huge amount of brand recognition throughout the U.K.“

It is understood that Castleplus prepared two valuation reports for the adjoining properties in November 2016.

The mouseinthecourt has seen court papers prepared by barrister Gary Lidington, instructed by Jonathan Smart of Shoosmiths solicitors, filed at the High Court.

Background

In or around late 2016 Mr Myck Djurberg applied to Lendy for loans totaling £4,500,000 for a period of 12 months, to be secured on two adjacent properties in his ownership:

The Chalet, Hampton Court Road, East Mosely, KT8 9BP (a five floor, four bedroom Swiss chalet style dwelling house.)

And Hampton Riviera, East Moseley, Surrey, KT8 9BP (a commercial premises consisting in serviced river berths with pontoons, boatyard berths, a dry dock, an office building and a garden area).

It is said that Lendy asked Castleplus “by a letter of instruction dated 16 December 2016…to provide valuations of The Chalet and The Hampton Riviera”.

One express terms is said to have been the valuations must be carried out “in accordance with RICS Valuation Standards“.

Another express term was that Castleplus “must bear in mind that the purpose of the valuation report was to enable [Lendy] to assess whether The Chalet and the Hampton Riviera were suitable for non-status loans and that while some due diligence would be undertaken on Mr Djurberg it was not as extensive as a mainstream lender might apply”.

A third express term stated “the valuations should give the marketing period if the property was vacant and put on the market at the date of valuation; the price that would be achieved and the likely effect on the price that a restricted 90-day marketing period would have“

Fourthly “the valuations would be made available to the Individual Investors“

Fifthly “the valuations should state what planning enquiries have been made and their results“

Lendy adds “It was an implied term of the Retainer that the valuations would be carried out with the reasonable care and skill of a surveyor working in the field of valuation“.

The Valuation Report: The Chalet

It is claimed by Lendy that Castleplus “in breach of the Retainer and/or negligently … materially over-valued the Chalet at £6,250,000 when its true value was in the region of £2,500,000“

Castleplus apparently “stated that the floor area of The Chalet was 8,838 sq ft rather than the actual floor area of 5,478 sq ft“

“failed to check the floor area of The Chalet in accordance with the RICS Code of Measuring Practice having been advised (by persons who are not identified in The Chalet Report) that the floor area was 8,838 sq ft“

“failed to check the planning status of The Chalet, assuming that it had permission to be used as a single dwelling house (C3), in circumstances in which its planning status was unclear and a perusal of the relevant records of the planning authority reveal a withdrawn application in 2012 to change the use of The Chalet to C3 and no evidence that such a change in use was subsequently granted“

“stated that the title to The Chalet extended to the River Thames when it did not”

“placed too much weight on agents’ asking prices in respect of The Chalet, in circumstances in which The Chalet was being over-marketed by being on offer through large numbers of agents and/or in circumstances in which that the asking price was driven by Mr Djurberg rather than the agent“

The Valuation Report: The Hampton Riviera

It is further claimed by Lendy that Castleplus “in breach of the Retainer and/or negligently … materially over-valued the Hampton Riviera at £2,650,000, when its true value was in the region of £1,500,000.“

Castleplus apparently “applied an inappropriate valuation methodology (namely an investment approach) in circumstances in which the Hampton Riviera was commercial land containing a trading business“

“failed to adopt the appropriate valuation methodology (namely a profits approach) in circumstances in which the Hampton Riviera was commercial land containing a trading business“

“failed to take into account adequately or at all the costs of operating The Hampton Riviera and the business“

“wrongly ascribed an additional valuation of £200,000 to the office building in circumstances in which it would ordinarily be assumed that the office was necessary for the operation and administration of the business, and was in fact so used“

“wrongly ascribed an additional valuation of £200,000 to the office building in circumstances in which it had limited suitability for letting given that there was restricted car parking and planning restrictions on its use precluding its use other than in connection with the marina forming part of The Hampton Riviera title“

“wrongly applied a berthing rate of £600 per metre, when allowing for relevant comparable berthing rates at Shepperton of £290 per metre and at Thames Ditton of £280 per metre, with an uplift of 40% to allow for a better location and larger pontoons, should have resulted in valuation in the region of £400 per metre“

“wrongly ascribed a value of £600,000 to the dry dock (rather than an appropriate value of £350,000) in circumstances in which it was not useable as a fully working dry dock (as it required a crane to install and remove dock gates)“

“applied an unrealistically small discount of 5% to the valuation on the basis of a 90- day marketing period, when 20% was the appropriate discount given the complexity of The Hampton Riviera and/or the limited market for properties of its type“

“failed to identify the actual income received from the berths“

“failed to allow for voids in the rental income from the berths“

Lendy’s conclusion

“Had [Castleplus] complied with its duties to the Claimants, then the Claimants would not have entered into the loans and mortgages…“

Because Mr Djurberg failed to repay the loans, and was subsequently declared bankrupt in September 2021, Lendy say the claimants “have suffered loss and damage of £2,450,239“.

(This sum having been calculated by deducting the capital sum advanced of £4,504,208.17 minus the net proceeds of sale of £2,053,969.17).

The burden of proof in any professional negligence case rests solely upon the claimant.

This site will keep an eye open for any developments in the litigation. You can support our crowdfunded journalism by donating to the Cheese Fund.

On 15th December 2022, in response to a previous article about the claim form being filed, A spokesperson from RSM UK said:

“The Joint Administrators can confirm that a claim has been filed in respect of loans PBL157/158 (known as the Chalet). Details of the claim will be filed in Court in due course. No further details are available at this stage, nor would it be appropriate to comment any further on this matter currently.”

We have approached Castleplus Ltd for comment.

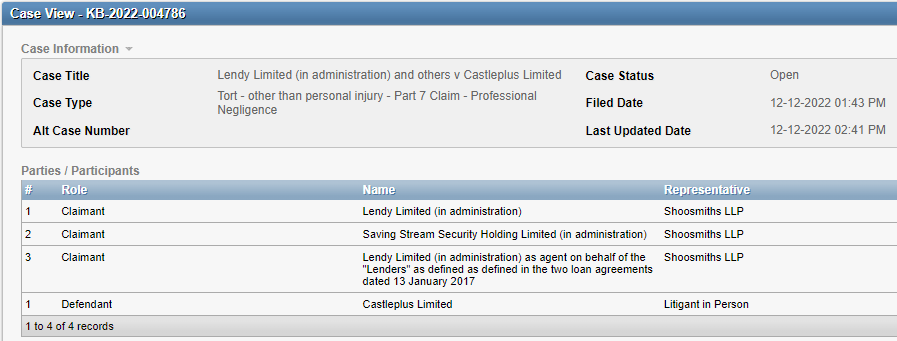

Case details

The High Court, Kings Bench Division

Case Number: KB-2022-004786

Claimants

1) Lendy Limited (in administration)

2) Saving Stream Security Holding Limited (in administration)

3) Lendy Limited (in administration) as agent on behalf of the “Lenders” as defined in the two loan agreements dated 13 January 2017

The claimants solicitor is Shoosmiths LLP

Defendant

Castleplus Limited

The defendants solicitor is Mills & Reeve

The work on this site is protected by copyright laws and treaties around the world. All such rights are reserved.

You may print off one copy, and may download extracts, of any page(s) from our site for your personal use and you may draw the attention of others within your organisation to content posted on our site.

You must not modify the paper or digital copies of any materials you have printed off or downloaded in any way, and you must not use any illustrations, photographs, video or audio sequences or any graphics separately from any accompanying text.

Our status (and that of any identified contributors) as the authors of content on our site must always be acknowledged.

You must not use any part of the content on our site for commercial purposes without obtaining a licence to do so from us or our licensors.

The bare minimum due diligence on ‘Myck Djurberg’ — a pseudonym that replaced the earlier neologised pseudonym of ‘Dr Salvad’Eor Priost’ — should have put any lender or investor in a position of total confidence that any and all monies would disappear. A mystery how a man can fool even the head of MI5, Dame Stella Rimington, as Priost, via SPI (some invented advertising ‘inspectorate’), itself after a series of property development scams, and then just change his name and raise millions against a property refurbished without planning permission and without paying the developers!

LikeLike