The peer-to-peer lending firm FundingSecure was ordered to refund an investor after making findings of misrepresentation and unfairness — But the platform entered administration before the investor could be compensated and the decision notice published.

Please donate to the Cheese Fund to support crowd-funded journalism of the P2P sector.

Reporting by Daniel Cloake.

FundingSecure were an FCA-regulated online peer-to-peer lending company which was incorporated in 2012.

They operated an online platform which allowed members of the public to collectively crowdfund loans used to fund the purchase and development of property. As well as pawn-broking style loans secured on “anything with a value including fine wines and comic books”.

Its website described itself as “the UK’s leading alternative investment and lending platform“ whose “peer-to-peer lending opportunities were carefully selected, appraised in detail, robustly structured and professionally managed by teams of proven sector specialists.“ As will become apparent that wasn’t always the case.

The firm collapsed in 2019 amid serious financial problems. Investors stand to make significant losses across a wide range of loans.

This site recently reported that investors in the platform had expressed “total, complete and utter ANGER” after the FCA concluded their 5-year-investigation — with no public action taken.

Since that article was written the mouseinthecourt was provided with correspondence from an investor who had made a complaint to the Financial Ombudsman Service in 2018. They asked we did not use their name in our reporting.

The Financial Ombudsman Service say they are “a free and easy-to-use service that settles complaints between consumers and businesses that provide financial services.“

The complaint centred around the investors £3,000 contribution towards a £650k crowdfunded loan purported to have been secured against a £1m power boat.

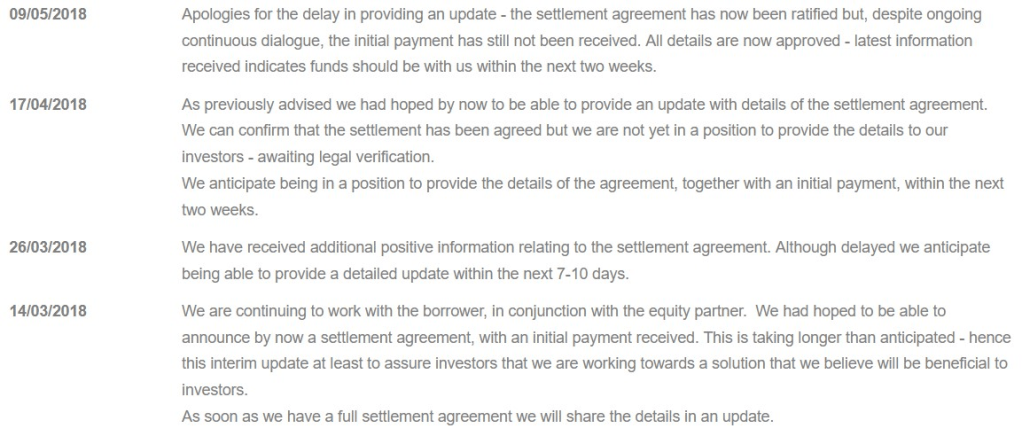

An image of the boat on the FundingSecure website

Ombudsman Danial Wyatt, in a 3-page-descison notice, explained that he had “taken a full review of the information supplied by both Fundingsecure and [the investor]“. He concluded that “based on what I’ve seen to date, I don’t think Fundingsecure have acted fairly so I’m upholding this complaint“.

We’re told that “the crux of this complaint is around the information given and the presentation of the loan and its investment risk“.

The investment had been presented to members of the public on the platform on the basis that it was 6-month-loan. We are told in the notice that the investor had contacted the service to complain when the loan had been active for 1043 days (ie 34 months) — A significant extension of the original term.

Mr Wyatt said he had heard evidence from the investor that there was “a real possibility he would not have invested” had he known the true position.

Mr Wyatt said, having reviewed the loan updates on the platform, that “although, it’s clear the borrower has been in contact with Fundingsecure, it’s also clear they have not been in a position to pay back its investors for the best part of three years“.

Wyatt said he understood “that the best chance of recovery is not to default the loan – but I don’t consider it fair that it’s at the expense of the lenders tying them into a loan that could continue to run indefinitely.“

“In addition, the power boat is listed as an asset valued at over £1 million. If the loan has the boat as security it seems like they could get investors’ money back plus interest.“

In a rather damning summing up of this fully FCA authorised platform Mr Wyatt said:

“As a crowdfunding platform, Fundingsecure are required to undertake a series of due diligence before offering a loan to investors. To date, I haven’t been provided with any evidence to say that Fundingsecure knew or were confident that the borrower was in a position to repay its investors with that six month timeframe.“

“Throughout my assessment, I believe there are two key areas in which I think Fundingsecure should’ve done more.

The first is either they should’ve completed more due diligence in which case chances are the loan would’ve have been made available.

In addition, the misrepresentation of risk of the loan not being able to be repaid, together with the lack of mitigation of its own default procedures.“

The investor was awarded £100 compensation because FundingSecure did not respond “to his complaint fully in writing and the distress and inconvenience this caused“.

More significantly the complainant was awarded “the cost of his investment in the powerboat loan to date plus 8% simple interest“.

These amounts however were never paid. FundingSecure challenged the decision and entered administration before a final ruling could be made.

According to loan updates shown to the mouseinthecourt the platform received funds from the borrower in October 2021 purportedly to have been made under a so-called settlement agreement.

This appeared to have the effect of combining this power boat loan with another loan on the website.

When the borrower eventually repaid the money was split across both loans. This was not a fact that appears to have been communicated to either the investors or in correspondence between the platform and the FOS.

A settlement agreement was mentioned in platform updates as early as March 2018 but despite a promise to “share the details” we’re told that this was never done.

It is not known if the ultimate size of the repayment, representing a capital loss of 84%, was mentioned in the settlement agreement in 2018.

Delay

We have seen correspondence between the investor and the FOS where frustration is expressed over the length of time it took before a final determination could be made.

In an e-mail dated October 1st 2019 the investor notes that “the thing that is concerning me is that you are in danger of setting the precedent that the timescale the FO takes to deal with things means that no P2P companies have anything to fear and in this environment that is looking worrying and potentially dangerous“.

The investor cited the case of Lendy which had entered administration a few months prior.

Daniel Wyatt told him “I can appreciate your frustrations but crowdfunding is a new financial product for our service. This means our service standard for the more common financial products like insurance claims or ISA’s isn’t applicable to crowdfunding cases.“

He added: “Due to the nature of these cases, we have to be very careful as a service to make sure our decisions are as thorough and consistent as possible. To date the ombudsman is still formatting an approach to this new financial product. This means decisions on complaints like this will take more time.“

He added “as far as our service is aware – Fundingsecure are still trading unlike Lendy, their platform update suggests they won’t be stopping anytime soon.“

FundingSecure entered administration twenty-four-days later.

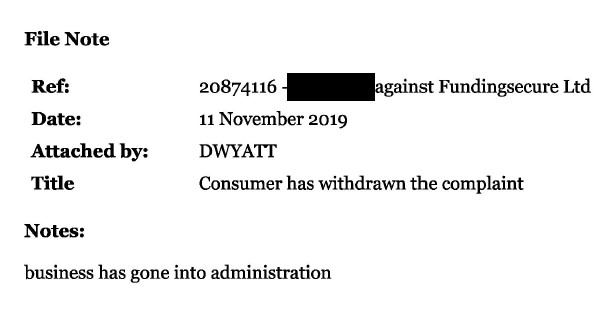

The FOS, apparently unable to consider a complaint against an insolvent company, recorded in a file note that the “consumer has withdrawn the complaint”.

We’ve heard an audio recording of a phone call between the case handler Danial Wyatt and the investor.

In the call, held post-platform-administration in November 2019, Mr Wyatt mentions that this wasn’t the only issue the FOS had been investigating against FundingSecure — “we’ve got several of these, we’ve got tonnes of these complaints actually” he said.

An independent review of the FOS, carried out by Richard Lloyd in 2018, found there was “legitimate frustrations about the speed with which the FOS resolves disputes“.

The latest report by an independent assessor found that “the Service still had significant backlogs and delays for most of the financial year [22/23]”.

In response to the report James Dipple-Johnstone, Deputy Chief Ombudsman, said their “ambition is to deliver the highest level of customer service.”

“We reduced our median time to resolve cases down to a little over three months by the end of the financial year, nearly half the time compared to the end of the same quarter in the previous financial year“

The FOS were “in the process of recruiting additional Senior Investigators, which will significantly increase the volume of staff that can handle our most complex and sensitive cases“.

Too little too late?

We approached the FOS for comment. A spokesperson told us “Unfortunately, we can’t comment on individual cases.”

Opinion

A common theme whenever I’ve spoken to members of the public who used these now defunct peer-to-peer lending platforms is a persistent criticism of the systemic processes that should have been in place to protect consumers.

In ‘Did internal politics and a culture of confusion at the FCA fail P2P investors?‘ this site heard from Lisa Taylor of the Lendy Action Group who talked of the FCA being “asleep at the wheel“. Marc Mason, a representative of the FundingSecure Action group, talked of “significant harm … caused to lenders due to numerous failed peer-to-peer companies that were under the supervision of the FCA.“

Had the FOS been able to act quicker amid the “tonnes” of complaints it is likely consumers would have been more alert to problems at the company and could have altered their investment behaviour. Final decision notices are published by the FOS.

When new financial products are launched, whether it’s peer-to-peer lending, cryptocurrencies, or the NextBigThing™, it’s vital that the UK’s system of consumer protection is nimble enough to prevent and reduce harm.

The work on this site is protected by copyright laws and treaties around the world. All such rights are reserved.

You may print off one copy, and may download extracts, of any page(s) from our site for your personal use and you may draw the attention of others within your organisation to content posted on our site.

You must not modify the paper or digital copies of any materials you have printed off or downloaded in any way, and you must not use any illustrations, photographs, video or audio sequences or any graphics separately from any accompanying text.

Our status (and that of any identified contributors) as the authors of content on our site must always be acknowledged.

You must not use any part of the content on our site for commercial purposes without obtaining a licence to do so from us or our licensors.

What I find remarkable is that despite voluminous evidence of fraud having been perpitrated by two of the directors of Funding Secure, they have yet to face criminal charges. It is also the case that the solicitors who acted in loans on behalf of FS and the investors/lenders have not been sued in negligence. They had an unequivocal responsibility and duty of care to the investors they were representing, yet accepted the instructions of FS to proceed with loans which on multiple occasions had defective security, and in some instances none existent security. I have numerously asked Edward Gee of CG&Co, the administrator for FS to provide the identity of the law firm, however, this has always been ignored. One has to wonder why. One also has to wonder why Edward Gee persistently fails to release investors funds back to them without legitimate grounds. I would also like to know why CG&Co have failed to comply with a high court order to return to investors/lenders hundreds of thousands of pounds unlawfully deducted from the proceeds of sales. CG&Co continue to spurious run up fees and costs charged to investors/lenders contrary to the interests of all other than themselves.

LikeLiked by 1 person