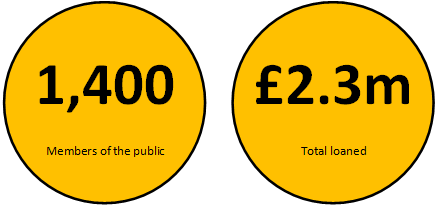

In 2016 an art dealer took out a series of short-term loans supposedly secured against valuable works of art. Over 1,400 members of the public collectively crowdfunded the money using the now-failed peer-to-peer lending platform FundingSecure.

In what is a truly remarkable story the art works promptly disappeared and the art dealer splurged the money, fled to Spain and was declared bankrupt, with seemingly no prospects of the loans being repaid to the member of the public who had invested.

Several years of litigation at the High Court followed, matters were complicated by FundingSecure itself plunging into administration amid accusations of fraudulent misconduct by a former director.

If you would like to support crowd-funded journalism of the P2P Sector please consider donating to the Cheese Fund.

Who’s who

The loans were facilitated by FundingSecure, a so-called peer-to -peer lending firm. The money was sourced from members of the public who collectively crowd-funded the total – some 1,400 investors “many of whom were ordinary consumers investing their personal savings” each contributed an average of £1,668.

FundingSecure were fully authorised by the FCA and were placed into in administration in October 2019 “partly because the company could not support the costs of ongoing litigation”. It is understood that the litigation described below formed one of those cases.

Apart from several small payments of interest, no repayments have been made by Mr Green and all the loans, almost 5 years later, remain outstanding.

Mr Matthew Robert Green, 54, is the son of the proprietor of Richard Green (Fine Paintings) ‘an International family art business of great distinction‘. Matthew used to work there but in his own words he says he was “removed from employment with the family gallery because of my dishonesty towards the gallery and my incorrigible behaviour.”

The first loan is discussed

On 11th October 2016, the then director of FundingSecure Mr Richard Martin Luxmore, 58, was approached by a Mr James Lawer, 54, asking whether they would be prepared to lend against five artworks secured by a personal guarantee from Mr Green.

As a side note – Mr Luxmore left the company in January 2019 following accusations made in the High Court that he created “false and fraudulent documentation so as to conceal” payments of £8.15m. Mr Luxmore denies the claims and is understood to have settled with the company in a private agreement in November 2020.

Mr Luxmore had previously made loans to Mr Lawer – indeed “A six month loan secured against a collection of 11 microsculptures” was one of them. Ultimately the members of the public who had collectively contributed £250,000 to that loan lost every penny. The update issued by the Joint Administrators speaks for itself:

“West Midlands Police made contact with the [FundingSecure] Joint Administrators. They advised that [the owner of the items] had no knowledge of the activities of James Lawer using his sculptures to raise funds from FundingSecure. The microsculptures had been reported as stolen and as a result the Joint Administrators had an obligation to surrender the asset. The microsculptures were surrendered to the police on 28 February 2020. There will be no return to investors.“

Loan Update issued on Loan #2995118349 in April 2020

Mr Lawer reportedly told Mr Luxmore that he could potentially introduce further wealthy individuals in need of short-term loans to the platform. He had apparently previously worked in the entertainment industry and said he had contacts.

Further correspondence took place between Mr Luxmore and Mr Lawer and negotiations about the security for a loan ensued. It is said Mr Luxmore understood that at all times Mr Lawer was acting on behalf of Mr Green.

FundingSecure instructed Robert James of Coram James (‘an independent firm of art, antique and jewellery valuers’) to value the proposed artworks. Mr James went on to value all bar facility 7, a painting by Lowry, which was valued by Cyzer Art Advisory. There is no suggestion of any wrongdoing by the valuers.

On 1st November 2016 a lunch meeting took place between Mr Luxmore, Mr Green and Mr Lawer, at which the proposed terms of the first loan were discussed, including the fact that there would be an administration fee and an arrangement fee split between Fundingsecure and Mr Lawer as introducer. Loan documentation was signed, comprising a facility agreement and a mortgage, and the loan of £255,000 was advanced on 2 November 2016. It is notable that Fundingsecure did not take these five items of art work into their possession.

Subsequently there were further approaches by Mr Lawer enquiring whether Fundingsecure would be prepared to make additional loans to Mr Green. The vast majority of the negotiations and correspondence were between Mr Luxmore and Mr Lawer. Loans two and three were negotiated together and signed by Mr Green at a second lunch meeting. With the exception of the final loan, the remainder of the loans were concluded via email correspondence.

In total there were seven separate loans although, because loan five was made in three separate tranches, there are in fact nine facility agreements. The list of loans, totalling some £2.3m, are listed at the end of this page.

The loan terms

The contractual terms for facilities one to eight are understood to have been made on materially identical terms. Facility agreement nine, which although differently drafted, was to substantially the same effect.

The court was taken to a number of clauses and these can be summarised as imposing three categories of obligation on Mr Green:

The first category were repayment obligations.

In other words Mr Green undertook to repay the loan with interest and other charges.

The second category of obligation are what have been described by FundingSecure as the “good title representations“.

Principally that Mr Green had full control over the Artwork and would retain full control over them.

The third category of obligation imposed on Mr Green are what have been termed the “previous facilities representation“.

In facility agreements 1 to 8, this was a promise that there was no continuing event of default. The effect of this, is that in the case of the first six loans Mr Green said that everything he had promised in all the previous facilities and mortgages had been and remained true and accurate.

And the artwork…

Importantly Mr Green was not required to hand over the assets, as one would expect with a pawn-style loan. He was merely required to give a contractual obligation:

“To keep the Chattels in his sole and exclusive possession at Constantine Ltd, Constantine House, 20-26 Sandgate Street, London, SE15 1LE“. Constantine being a provider of “fine art logistics for private collectors, museums and galleries worldwide“.

And (among other clauses) “Not to permit to be done anything that would or might depreciate, jeopardise or otherwise prejudice the security held by the lender or materially diminish the value of any of the chattels“

The relationship between the platform and the investor was not examined as part of these proceedings however the following two clauses from the FundingSecure’s T&C’s are worth noting:

Clause 2.1 of the Loan Agreement states:

2.1 The Security is held by us as bailee for value and as security trustee for the Creditors.Clause 1.2 of the terms and conditions version 2.4:

1.2 FundingSecure … holds Borrowers’ pledged Assets as security for Loans entered into.

The investors may well have felt that the artworks should have been ‘held’ by FundingSecure.

We approached the Financial Conduct Authority for a comment on this arrangement and they told us they:

“don’t have specific rules as to how/if a firm chooses to secure a loan with a borrower, this is a commercial decision on their part. Our expectation is that firms are clear fair and not misleading about the information they provide.“

How it’s said FundingSecure were duped

With the exception of the Picasso print, which had been valued at the Delahunty Gallery, the remaining artworks had all been inspected at the premises of Constantine Fine Art Storage and Logistics.

The court was told that Constantine’s have a large open area divided into different numbered ‘bins’. Each bin has a reference number and is assigned to a specific client. Only that client’s representatives are allowed to access the items in each bin.

When artworks are pawned, they are often transferred to the pawnbroker’s bin, and that is treated as a transfer of possession. If sold, they may be transferred to the buyer’s bin. The fact that an item is in a particular person’s bin therefore indicates that that person has exclusive access to, and control over, the item in question.

In September 2017 Mr Luxmore asked Mr James (of Coram James ‘an independent firm of art, antique and jewellery valuers’) what he could remember about the valuations that he had carried out on behalf of FundingSecure at Constantine’s.

Mr James said that he had been escorted by Mr Green’s driver and a man answering the description of a Mr Welsh who also worked for NBSP. On this basis, Mr Luxmore says that he strongly suspected that at the time of the valuations, all the artworks in question had been stored in the New Bond Street Pawnbrokers’ bin, thereby indicating that those items had in fact already been pledged to NBSP.

A ‘freak accident’ occurs

On 1 May 2017, the original six‑month term of facility 1 came to an end. The loan could be extended for a further six months on payment of interest and Mr Luxmore texted the defendant stating that he needed to collect interest and administration fees. Mr Green replied that he was abroad, that the payment was being dealt with by Mr Lawer and that was all in hand. The interest was eventually paid over the period 19th to 22nd May 2017 and the loan was extended. Loans two to five were similarly extended although loans six and seven were not.

On 24th August 2017, at a time when Mr Green was pressing for a further loan, Mr Luxmore received information from another peer to peer lender (Unbolted) that one of the paintings supposedly providing security for facility 2 had been pledged to New Bond Street Pawnbrokers (“NBSP”) as security for a loan to Mr Green.

My name is Rito Haldar and I am one of the Directors at Unbolted. I have been alerted to various questions raised about the Munnings painting on this forum and I would like to categorically state the following:

Forum post made on 24th Aug 2017 by a director of a fellow P2P company who was offered the art work

– We have a valuation from Christies on email (an auction estimate). They would have inspected and authenticated the painting prior to us loaning on it. We would not have loaned on the painting without taking it in possession.

– The listing of the loan was not speculative. I can confirm that we were offered to take the painting in possession immediately and had not done so, as we were waiting for an appointment with the specialists at Christies.

Thanks

It is said Mr Luxmore immediately called Mr Green and Mr Lawer. Green stated there had been a mix-up. He promised to settle his debt with NBSP and the next day Mr Luxmore received an email confirming that the NBSP loan had in fact been settled. An assurance was given that the whole episode was a freak accident which would never happen again.

Over subsequent days and weeks it came to light that some, if not all, of the artworks which were supposedly providing security for FundingSecure’s loans (and the 1,400 members of the public standing behind them) had also been pledged to NBSP, although it was unclear when. There is no suggestion of any wrongdoing by NBSP.

The court was shown a document provided to FundingSecure by NBSP in September 2017 entitled ‘Customer contract summary’. This gave a list of artworks and their value. There are columns headed “Loan date”, and “Status” and then there are two further columns headed “Redeem date” and “Renew”, both of which contained values rather than dates.

The precise import of this document is not entirely clear. In particular, the court found it debatable whether the column marked “Loan date” sets out the date of the original loan made by New Bond Street or only the date of the most recent renewal of such a loan.

As Ted Loveday, the barrister (and part-time meme) who represented FundingSecure at a hearing in January 2019, rather diplomatically put it: “If better evidence of the sequence of events was available from [NBSP], it had not been obtained.”

Indeed, a High Court Judge criticised the quality of this evidence: “I do not know why further enquiries were not made by the claimants of New Bond Street, who could surely have clarified the situation, and Mr Loveday was unable to enlighten me.“

Nonetheless the document clearly showed that NBSP had been dealing with Mr Green since at least September 2016, in other words since before the grant of the first loan by FundingSecure.

On 12th September 2017, NBSP provided a further document showing a list of all security that they were holding on behalf of Mr Green. The description of some of the items on both lists corresponded with the artworks that were supposedly securing the loans.

On 13th September 2017, Mr Luxmore had a meeting with Mr Green and Mr Lawer when they attempted to reconcile these documents. According to Mr Luxmore’s evidence Mr Green “was vague in his answers, and appeared distracted“. When asked how he could have executed security over the same artworks to two different lenders, he apparently told Mr Luxmore that a Mr Welsh, whom he described as his consultant, also worked for New Bond Street and that sometimes assets became mixed up.

Various proposals were made by Mr Lawer to resolve the situation through the grant of further loans but FundingSecure refused to lend any further money in the light of the irregularities which had come to light.

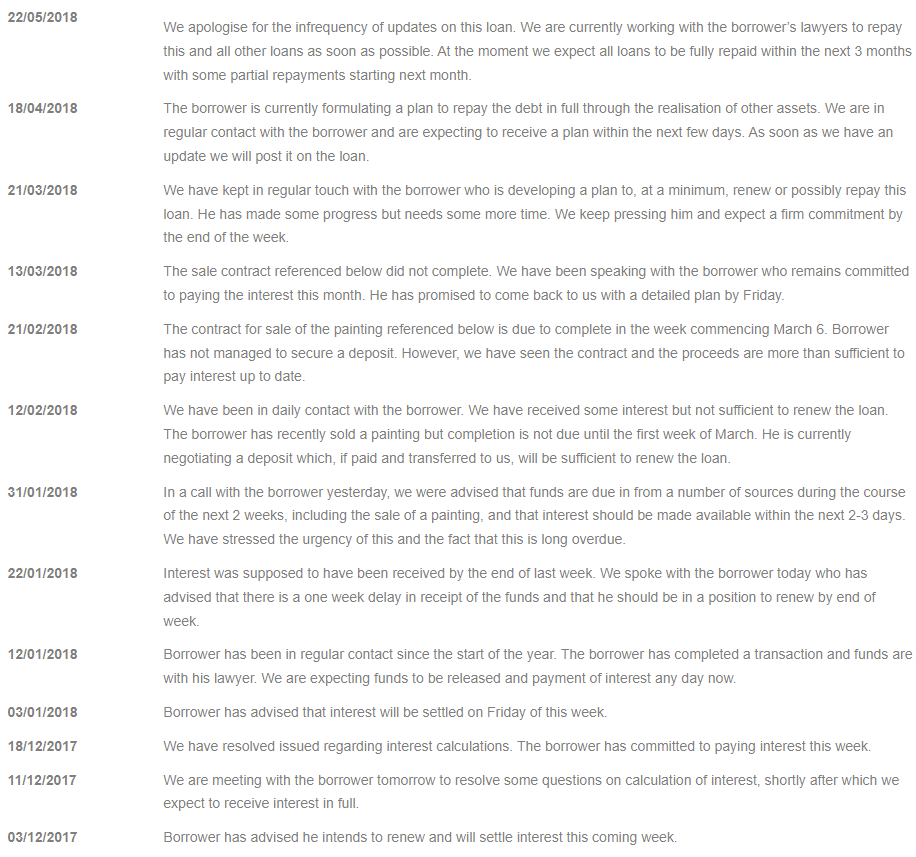

From October 2017 to April 2018, FundingSecure made a series of requests for payment from Mr Green by phone, text message and email. Mr Green repeatedly promised to pay but failed to do so.

On 3rd December 2017 FundingSecure emailed Mr Green a summary of all the outstanding loans, interest and fees which were due.

Repeated requests for payment by Mr Luxmore were met by a response from Mr Green that he was arranging funds. He said that Mr Lawer was his appointed agent in the matter and that Mr Luxmore should liaise with him on all matters. Numerous assurances for payment were made on the basis that Mr Green was about to close a lucrative deal or that he was expecting a large deposit. All these assurances came to nought and apart from some relatively small payments of interest, nothing was forthcoming.

One of the assurances of payment made was on 12th February 2018, when Mr Lawer forwarded a message to FundingSecure from Mr Green giving details of a deal involving a Picasso work. Apparently, Matthew Green had agreed to buy it for £3.5 million, and was going to sell it to a US company for £6.7 million, thereby realising a substantial profit.

Meanwhile….

US Legal Proceedings begin

In circumstances unconnected with Fundingsecure, Mr Matthew Green was “Charged in a $9 Million Picasso Money-Laundering Scheme” in early 2018. The legal filing includes the allegation that:

In or about and between October 2017 and February 2018, the defendants PK, AA and MATTHEW GREEN, together with others, devised and engaged in a scheme whereby they agreed to launder money by facilitating financial transactions to and from the United States, which transactions involved property represented to be proceeds of fraud in the sale of securities.

Paragraph 20 of an indictment filed at the US District Court

The nature of the charge means that Mr Green becomes “concerned not to enter the UK for fear of extradition” which, it’s suggested, is why he fled to Spain. Written submissions made at a court hearing in March 2022 describe him as “a fugitive” because of this.

This chapter of the saga was covered by a British tabloid who ran a story in October 2018 entitled “The Sun finds Boris Johnson’s art dealer pal Matthew Green hiding in Spain while on the run from the FBI“. The article is said to contain a picture of Mr Green “dancing in the street to impress a girl in a passing car before blowing kisses to her“.

Meanwhile….

FundingSecure become ‘seriously alarmed’

On 6th March 2018 Mr Luxmore gave Mr Green notice that all the loans were overdue and insisted on payment as soon as possible. At a minimum he required all the security to be handed over. Thereafter, attempts to speak to or contact the defendant became increasingly difficult. Despite assurances at various times that he intended to pay, and had plans for doing so, nothing further was in fact paid.

On 20th April 2018 Mr Green’s solicitor informed Mr Luxmore that he believed his client to be insolvent with debts of about £10 million.

On 26th April 2018, FundingSecure instructed Walker Morris LLP to litigate this matter. (As a side note, when FundingSecure entered administration, Walker Morris were listed as a creditor for circa £110k. It is unknown what work this amount relates to.)

By 14th May 2018, some 8 months after discovering the artworks had been pledged to NBSP, FundingSecure “had become concerned” as to whether Mr Green might have been in breach of the terms of the loan documentation.

A pre-action letter was sent by Fundingsecure’s solicitors, Walker Morris, to a Mr Rupert Boswall, a solicitor at the city firm, Reynolds Porter Chamberlain, who at that point were acting for Mr Green. This letter made a formal demand for payment and expressed concern about the veracity of the representations made and for the location of the artworks.

No response was received to that letter and a second letter was sent on 7th June 2018, outlining their claim, demanding payment and requesting information about what had happened to the artworks.

By this time FundingSecure had been alerted to the fact that one of the pieces, a painting by Dufy, had been sold. The sale, reportedly for £111,189 at an auction in New York on 16th May 2018 was to one Helen Macintyre.

FundingSecure “was seriously alarmed at this news” and asked for immediate remittance of the sale proceeds, as well as confirmation from Mr Green of the whereabouts of the other artworks, that he still owned them and that they were unencumbered. An urgent reply was requested.

The members of the public who had invested in the loans were not informed of any of these developments.

UK Legal Proceedings begin

With no response to their letters forthcoming, on 13th July 2018 FundingSecure issued proceedings at the High Court in London and made an application for a worldwide freezing order.

Those claims made by FundingSecure subsequently evolved and were refiled in an Amended Particulars of Claim dated 4th October 2018.

It is said that “on various occasions before August 2017, Mr Green delivered each of the artworks into the possession of James Page Financial Services Ltd (Trading as NBSP) by way of pledge“…”As a result, each loan was procured by Mr Green’s deceit in that, in respect of each loan, the good title representation and/or the previous facilities representations were false“.

This allegation of deceit is legally very important – if successful it means that if Mr Green is made bankrupt FundingSecure can rely upon s.281(3) of the Insolvency Act 1986. This provides that “Discharge does not release the bankrupt from any bankruptcy debt which he incurred in respect of, or forbearance in respect of which was secured by means of, any fraud or fraudulent breach of trust to which he was party“. In simple terms – the debt will survive any bankruptcy.

Assets frozen

The application made some 10 days prior came before Mr Justice Barling at the High Court on 24th July 2018. What probably wasn’t anticipated was that the litigation would rumble on for the next 43 months.

Immediately prior to the hearing FundingSecure received a five-page witness statement from Mr Green which it is said was the first occasion on which any explanation had been attempted.

In this statement Mr Green describes his state of health and that he had been in rehabilitation in Spain since February 2018. He referred to his indictment by the US authorities in relation to the prospective sale of the Picasso painting and to ongoing divorce proceedings. He also mentioned that he had been employed by his family’s art gallery for over thirty years, but that his employment had been terminated in June 2018.

He accepts that he is insolvent with debts of millions, including debts to the creditor who ultimately presented him with a bankruptcy petition, MBU, for over £500,000. He also accepts that he is indebted to FundingSecure in the sum of at least £2.4 million.

There is a bald assertion without further explanation that “I do not have control or possession of the artworks referred to by the claimant“.

In the statement he also apologised to his creditors, including FundingSecure, for the losses he had caused them, but argued that the appropriate course was to allow the bankruptcy to proceed rather than to impose a freezing order.

Mr Green was represented at that hearing by solicitors and counsel. The world wide freezing order was granted by the court and expressly provided for Mr Green to give detailed information about the whereabouts of the artworks by 30th July 2018, specifically:

Their current location; all persons, who had any legal, beneficial, possessory or security interest in the artworks, and the nature of any such interest; whether the defendant had had any legal, beneficial or security interest in the artworks, or possession of the artworks, at any time; the nature of that interest, whether it had been disposed of, and if so, when, how, to whom and for what consideration; and if he had never had any legal, beneficial, possessory or security interest, all persons who had had any such interest. And if any of these matters were not within his knowledge he was ordered to state why they were not within his knowledge.

Where’s the Art?

It subsequently came to light and was substantially confirmed in Mr Green’s own evidence, that between August 2017 and July 2018 he had in fact sold all the artworks without remitting the proceeds to FundingSecure.

The Dufy painting Les Regates (perhaps more aptly considered as Les Regrets by FundingSecure), supporting the first loan, was apparently sold by Mr Green at Christies in New York to Helen Macintyre of Arts Advisory on 16th May 2018.

The Auerbach and Sickert paintings were reportedly sold to Offer Waterman, an art dealership in London.

The remainder apparently were sold to Richard Green (Fine Paintings) Limited, a well‑known art dealership owned by Mr Green’s family to whom he was substantially indebted.

There is no suggestion of any wrongdoing by the above purchasers.

Non-disclosure of assets

On 17th August 2018 Mr Green made an unsigned witness statement, purporting to give asset disclosure in accordance with the freezing order. That statement contained the following evidence: that all of the items scheduled to the worldwide freezing order, including the artworks supporting FundingSecure’s loans, were disposed of “some time ago, principally to Richard Green (Fine Paintings)Green (Fine Paintings) Limited“. Mr Green confirmed that he had purchased the items in question on credit terms and that he had used the loans from FundingSecure to assist in financing the purchases.

FundingSecure took the view that the asset disclosure was insufficient and applied to the court for an order that Mr Green be put in the witness box and cross-examined on his assets. This application was approved by Mr Justice Zacaroli who made an order on 3rd October 2018 on the basis that Mr Green had failed to comply with his disclosure obligations under the freezing order.

On 25th October 2018 a short defence was served by Mr Green and a hearing was listed for 26th November 2018, that being the same date that had previously been fixed for his asset cross-examination. Mr Green, unsurprisingly, failed to appear and the judge Mrs Justice Falk made an order, amongst other things, giving directions for the litigation to continue.

FundingSecure served further evidence in accordance with the order of Mrs Justice Falk on 30th November 2018. Mr Green put in a statement in response on 13th December 2018 to which FundingSecure replied. However, although this reply was dated 21st December 2018, that being the last date permitted under the order, it was not in fact served until the 4th January 2019, which was outside the time limit. As no explanation was given to the court for that delay it was ruled inadmissible.

Summary Judgment – January 2019

The substantive hearing for Summary Judgment was heard before Judge Ms Julia Dias QC (sitting as a Judge of the Chancery Division) on 28th January 2019.

FundingSecure ran three claims against Mr Green and rather than requesting a trial, they tried to convince the court that there was no real prospect of Mr Green defending the claims. This is known as summary judgment.

Summary judgment is a procedure by which the court makes a judgment against one of the parties on the whole of a claim or on a particular issue if it considers that:

An explanation of ‘summary judgment’ from Saunders Law

– A claim or issue or a defence to a claim or issue has no real prospect of success; and.

– There is no other compelling reason for a trial.

The three claims were:

– A claim in debt for payment of the outstanding principal amount of the loan together with interest and fees.

– Damages for dishonest breach of contract.

– Damages for deceit on the basis that Mr Green had made representations to FundingSecure which induced it to enter into and/or extend the loan facilities, which representations were known to be false and/or as to which he was reckless.

The amended particulars of claim also raised a claim for an indemnity, but that was not pursued as part of this summary judgment application.

Mr Green was not present and was not represented at the hearing. The court ruled that they were satisfied that FundingSecure had taken sufficient proper steps to notify Mr Green of the hearing and that notice had almost certainly come to his attention. The court considered that he had been given ample opportunity to apply for an adjournment if he wished – and indeed no such application had been intimated. Therefore “it was appropriate in accordance with the overriding objective to proceed with this application“.

FundingSecure were represented by barrister Ted Loveday, instructed by Walker Morris LLP.

Claim – Judgment Debt

This was a straightforward contractual claim in debt for the amount of principal, interest and fees outstanding under the agreements.

As regards the claim in debt, the court took “this very shortly“.

Judge Ms Dias QC considered Mr Green’s first statement, which was served at a time when he was advised by solicitors and counsel, which accepted that he owed FundingSecure at least £2.4 million. It was not disputed by him in that statement that he had entered into the loan agreements; the only uncertainty appeared to have been as to the precise amount.

The court ruled that “On any view therefore, the claimant is prima facie entitled to recover the amounts outstanding under the terms of the loan documentation itself, and the amount recoverable is the same amount as that recoverable as damages in relation to the contractual claim.“

Claim – Deceitful breach of contract

FundingSecure made the allegation that all the artworks which were proposed as security for each loan had already been pledged elsewhere at the time their loan agreements were entered into. They claim that Mr Green was fully aware of this, and that it followed that he made the ‘good title representations’ knowing the same to be false, or at the very least being reckless as to whether they were true or false.

In order to establish a claim for deceit, FundingSecure had to satisfy the court on four essential ingredients:

1) Firstly that there was a representation (ie a statement) made to them by or on behalf of Mr Green.

2) Secondly, that the representation was false.

3) Thirdly, that it was made fraudulently.

4) And fourthly, that Mr Green made the representation with the intention that it should be relied upon, coupled with actual reliance.

As to the first of these, the court found “there can be no serious doubt that representations were made by the defendant in the terms of the facility agreements and mortgages set out above“

As regards falsity, the second point, the primary case put by FundingSecure was that the representation that Mr Green had full control over (ie held unencumbered title) to the artworks was false, because in each case it is said the supporting artworks had already been pledged to New Bond Street prior to the FundingSecure loan agreements being signed.

The court had some difficulty with this assertion. It was accepted that in Mr Green’s second statement he said that all the artworks were pledged at some stage to New Bond Street but there were no details as to when they were pledged.

Explaining that “the documentation from New Bond Street does not take the matter further, given the uncertainty regarding the dates” the judge declined to find that all the artwork had been pledged prior. – “I am not prepared to infer from this meagre information alone that each of the artworks was pledged prior to the loan to which it related“.

The one exception was facility 9, the Lowry painting “where the evidence appears clear”.

As a second bow to their string, FundingSecure had also advanced an argument that because they had clearly alleged on numerous occasions that the artworks were already pledged prior to being offered as security and that this had never been denied or contradicted by Mr Green, this proved their claim.

The court could “see force in that submission” and “far from taking that opportunity to put forward any different version of events, the defendant simply ignored the allegations” and he “cannot have been in any doubt as to the centrality of this averment to the claimant’s case on dishonesty“.

However, the court found that FundingSecure faced a significant difficulty in this respect finding “it is one thing to say that a defendant admits an otherwise sound case by failing to plead a positive alternative. It is quite another to say that the claimant is entitled to summary judgment on a deemed admission when its own evidence does not satisfy me that the factual basis of the allegation is made out.“

The court found that FundingSecure “could easily have obtained clarificatory evidence from New Bond Street itself” and that “no explanation has been provided as to why that has not been done“. The judge concluded “I do not consider it appropriate to rely on a deemed admission for this purpose. The burden of proof is on the claimant to establish its case, and I am not prepared to infer that all the artworks had in fact been pledged prior to the dates of the loans“.

As FundingSecure had only satisfied the court in respect of the Lowry painting the judge only had to consider the third test for that single loan. “It seems to me that the defendant cannot have failed to appreciate that the Lowry painting had already been pledged to NBS when he offered it as security for loan 7. It cannot have slipped his mind that a few weeks earlier he had obtained money from New Bond Street on the security of the self-same work.“

The final test – reliance – was easily dealt with: “It seems to me the defendant was fully aware at all times that the existence of unencumbered security was a matter of great importance to the claimant.“

So the claim for deceit was made out – but only for one of the loans.

Claim – Dishonest breach of contract

FundingSecure says that there was a dishonest breach of contract in that the subsequent outright sale of the artworks was a deliberate and dishonest breach of Mr Green’s contractual obligation not to dispose of them.

It was also said that Mr Green was in breach of contract by failing to provide information about the artworks and failing to notify FundingSecure promptly of any misrepresentations or breaches as he was obliged to do by the terms of the loan documentation.

The court considered that there were two issues to be resolved:

1) Did Mr Green breach the facility agreements or mortgages or any of them?

2) If so, was such a breach dishonest?

The breaches that FundingSecure say happened were, first, the selling of the artworks when Mr Green was contractually obliged to keep them in his sole legal and beneficial ownership; and secondly, continuing to deal with FundingSecure without informing them of the pledges or sales that had been entered into, despite a contractual obligation to do so.

As to the first of these breaches, that is the sale of the artworks, Mr Green’s first statement simply stated that he did not have control or possession of the artworks as of 24th July 2018. That in itself did not necessarily mean that they had been sold. However, his second statement stated unambiguously that they had in fact all been sold, the majority of them in around August 2017. No dates were given for the sales but they must at least have been before 24 July 2018 when the first statement was made.

The Judge found it “incontestable that the defendant did not inform the claimant of the sales or of the pledges, let alone obtain its prior consent” and “in those circumstances it seems to me there have been the clearest possible breaches of contract.”

As to whether such breaches were dishonest, the court applied the normal test for civil dishonesty and asked “did the defendant know of elements of the transaction in question which made it dishonest according to normally acceptable standards of behaviour? In other words, would an ordinary honest person, knowing what the defendant knew, have acted in the same way in the circumstances?“

The judge concluded that “I have no doubt that the defendant’s breaches of contract were dishonest in this sense. He obtained a total of some £2.3 million from [FundingSecure] on the basis of contractual undertakings not to dispose of or encumber the security for the loans” and then “sold the artworks in question, apparently to pay off other creditors. The sales were therefore clearly deliberate, and must have been the subject of some forethought and planning, if only to decide which creditors to pay.” Adding “I am completely satisfied that any ordinary honest person would have found this behaviour to be dishonest. I therefore find that the defendant was in breach of his contractual obligation not to sell or encumber the artworks, and in his failure to keep the claimant informed. I also find that these breaches were dishonest.“

This finding of dishonestly across all the loans is very important – it meant the debt survives bankruptcy.

Green: I was in a vulnerable state

As part of the summary judgement application the court did have to consider whether Mr Green had any prospect of defending the claims.

On 24th October 2018 Matthew Green had filed a defence statement at the court. Judge Julia Dias QC described this as “a somewhat surprising document, being a mere four paragraphs long, barely a page of A4“. In it Mr Green denied that he was indebted to FundingSecure on the basis of undue influence and invited the court to treat the agreements as “null and void“.

Green says Mr Luxmore knew he was in a vulnerable state due to his poor mental health and various addictions.

Ms Dias QC explained that the suggestion of undue influence had only emerged for the first time on 24th October 2018 and there had been no mention of any such defence before that. The court considered both the express admission of the debt and the explicit apology to his creditors and to a statement in which Mr Green explained that taking out the loans “seemed like good business”.

These statements were “wholly inconsistent with his current case that the agreements in question were void or voidable for undue influence.” Judge Julia Dias QC added “I am satisfied that the defendant has no real prospect of establishing any undue influence on the facts.”

Green: “I was plied with copious amounts of alcohol”

Mr Green had also made an assertion that the loans were made “very often following lunches where I was plied with copious amounts of alcohol“.

The court considered that this was only relevant to the first three loans and loan seven, as all the others had been concluded by email.

The judge found it was “clear from the correspondence that the negotiations for loans 1, 2 and 3 had all been concluded before the lunches with [Mr Green] took place“. In other words, it was only his signature which was required having already agreed the terms beforehand. The court found there was no suggestion that he was labouring under any alcoholic or other influences when those terms were negotiated.

What next?

With the debt confirmed by the High Court the difficult step of getting the money back commenced.

Part 2 of this saga – ‘The Great Green Art Fraud – How FundingSecure lenders got their money back’ will be published shortly.

We contacted Mr Green for a comment on an e-mail address used to effect service of court documents. We received no response.

The Loans

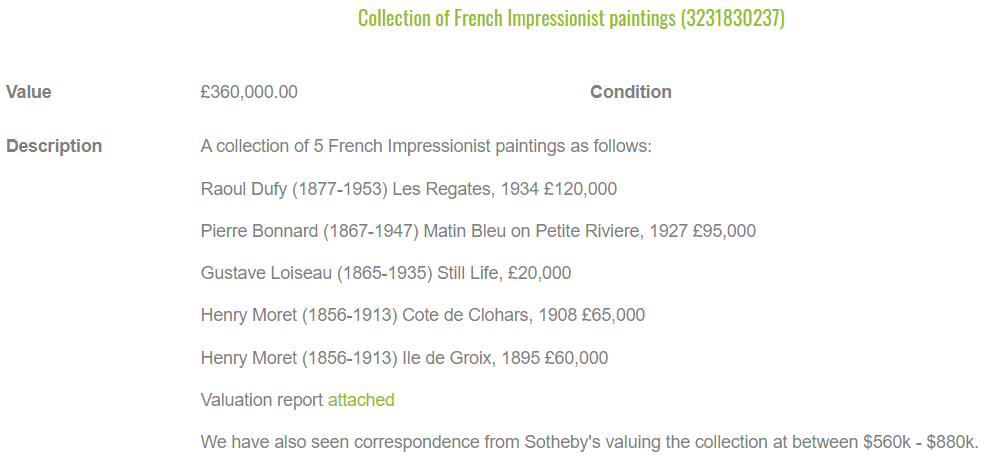

Facility 1 – Impressionist Paintings

Ref: 1447116747 & 8850220627 & 8859773920

Date Start: 02/11/2016

Loan Size: £255,000

Fee: £5000

“A 6 month loan secured on a collection of 5 French-impressionist paintings.”

Facility 2 – Fine Art

Ref: 3791904621 & 3020915407

Date Start: 02/12/2016

Loan Size: £494,700

Fee: £9,700

“A 6 month loan secured on a collection of 4 paintings.”

Facility 3 – Collection of Vases

Ref: 1298763968 & 1179005019

Date Start: 02/12/2016

Loan Size: £86,700

Fee: £1,700

“A 6 month loan secured on a rare collection of antique vases.”

Facility 4 – Auerbach

Ref: 1311869508 & 2442801065

Date Start: 23/12/2016

Loan Size: £155,000

Fee: £5,000

“A 6 month loan secured on a painting by Auerbach”

Facility 5 – Picasso Tranche 1

Ref: 2580819685 & 1763618002

Date Start: 16/01/2017

Loan Size: £206,000

Fee: £6,000

“The first tranche of a facility loan of £618,000 secured against an extremely rare Pablo Picasso etching”

Facility 6 – Picasso Tranche 2

Ref: 1018164427 & 2909973008

Date Start: 23/01/2017

Loan Size: £206,000

Fee: £6,000

“The second tranche of a facility loan of £618,000 secured against an extremely rare Pablo Picasso etching.”

Facility 7 – Picasso Tranche 3

Ref: 2201653534 & 1944450730

Date Start: 03/02/2017

Loan Size: £206,000

Fee: £6,000

“The third tranche of a facility loan of £618,000 secured against an extremely rare Pablo Picasso etching.”

Facility 8 – Marc Chagall

Ref: 5073631341

Date Start: 09/06/2017

Loan Size: £463,500

Fee: £13,500

“A 6 month loan secured against La Revolution – Marc Chagall”

Facility 9 – Lowry

Ref: 1614460897

Date Start: 26/07/2017

Loan Size: £250,000

Fee: £7,500

“A loan secured on a painting by LS Lowry. The painting is held at Constantines, London.”

The Matthew Green loans are an example of numerous other seriously, and likely criminally, defective and either largely or wholly unrecoverable loans by the directors of Funding Secure using individual investors funds.

LikeLike